First time posting. Apologies for the lack of complete information, I'm still trying to wrap my head around the numbers myself.

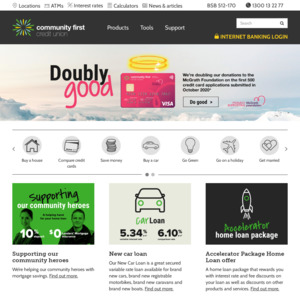

I was trying to find the best deal for a owner occupier home loan with an offset account, I haven't heard of Community First Credit Union before, but they are doing really good offers at the moment. I was hoping people would share their experience and thoughts on this bank and deal - if they are legit and thrustworthy.

2 year fixed package rate loans (max LVR 80%) from 1.99% p.a. Comparison rate from 3.25% p.a.

2 year owner occupier variable rate for new lending (max LVR 80%) from 1.99% p.a. Comparison rate from 3.25% p.a.*

- discounted variable rate is a discount of 2.65% p.a. off the standard variable home loan rate for a period of 2 years.

Application fee and legal fee waived

Other valuation, legal and variation fees may apply

$0 monthly fee

$395 Accelerator Package annual fee

Redraw fee:

Internet - free

Staff Assisted (including BPAY®, internal and external transfers) $30

Worth getting just for the free internet !!!