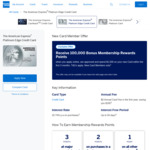

Looks like this deal is back. Not sure if it's only available via the fb targeted link, or everywhere.

https://www.americanexpress.com/au/credit-cards/platinum-edg…

Edit: Looks like the same offer is being offered on Referrals - Cycle through those instead and get a fellow OzBargainer some free points.

Travel Credit…