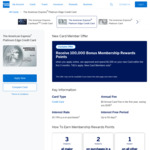

The American Express® Platinum Edge Credit Card.

New Card Member Offer

Receive 100,000 Bonus Membership Rewards Points when you apply online, are approved and spend $1,500 on your new Card within the first 3 months. $0 Annual Card Fee in the first year, saving you $195. T&Cs apply. New Card Members only1

Bonus & Eligibility 100,000 Membership Reward Bonus Points are only available to new American Express Card Members who apply, are approved and spend a minimum of $1,500 on your new Card within the first 3 months from the Card approval date. This is a limited time offer and may not be available if you leave this web page and return later. Please allow 8–10 weeks for the bonus points to be credited to your account after the spend criteria has been met. Card Members who currently hold or who have previously held any Card product issued by American Express Australia Limited in the proceeding 18 month period are ineligible for this offer. Eligible purchases do not include annual Card fees, and fees and charges for traveller’s cheques and foreign currencies. This advertised offer is not applicable or valid in conjunction with any other advertised or promotional offer.

Travel Credit. American Express Platinum Edge Credit Card Members are eligible for one Travel Credit of $200 per year.

Update: Just called them and sent my NOA. Approved on the spot (literally applied today). Sales rep confirmed 100,000 points bonus, $0 annual fee for the first year and no fee on second card holder.

I'm not actually sure why some people see only 50,000 points. Please see my screen shot: https://imgur.com/a/rKjr0X5

Update #2:

So I'm using Google chrome on my PC and Phone and both show 100,000 bonus points.

When I use Edge and Firefox, they show 50,000 points.

I'm not sure why this is the case but its worth a shot.

Update #3:

Just got my card. Real quick. A week after approval.

Update #4:

Got my 100,000 bonus points today!

https://imgur.com/a/DylK2oJ

So what can you get for 100k points these days? They have devalued the points I remember.