All Ozbargainers

AMP has extended their cashback offer to 30th of June 2023

**These are the latest rates (including the March rate increase)

Great cashback and great variable rates for refinance & purchase applications. Note that there is only one cashback per customer, irrespective of the number of properties.

Principal and Interest Owner Occupied HOME LOAN

AMP Essentials Home Loan 5.14% CR 5.17 % at 70% LVR

AMP Essentials Home Loan 5.24% CR 5.27 % at 80% LVR

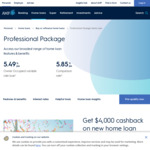

Professional Package Variable 5.49% CR 5.85 %

1 year fixed - 5.99% (CPR 6.19%) FOR LVR <80%

2 year fixed - 6.19% (CPR 6.29%) FOR LVR <80%

Principal and Interest INVESTMENT HOME LOAN

AMP Essentials Home Loan 5.34% CR 5.37 % at 70% LVR

AMP Essentials Home Loan 5.44% CR 5.47 % at 80% LVR

Professional Package Variable 5.64%

1 year fixed - 6.09% (CPR 6.20%) FOR LVR <80%

2 year fixed - 6.24% (CPR 6.22%) FOR LVR <80%

Cashback’s conditions are:

• $4,000 cashback offer where home loan amount is $750 000 or more

Applicable for new refinance applications

Minimum refinance and or purchase home loan amount of $750,000

Only one cashback offers per eligible home loan capped to one cashback offer per applicant within a 12 month period from the last settlement date to the current application submission date.

We also offer the following product as well

St George- 5.24% for Owner Occupied + $4,000 cashback

Westpac- 5.14% variable rate for Owner Occupied up to $4000 cashback

Ubank- 5.24% variable rate for Owner Occupied up to $5000 cashback

ANZ - 5.34% variable for Owner Occupied + $4000 cashback

Expired Heroes Home Loans are also providing an additional incentive broker rebate of up to $4,000 if user our service (note this applies to all products). The broker rebate is based on the net loan amount ie (loan size minus redraw/offset etc). https://www.ozbargain.com.au/node/736812

Please feel free to email me at [email protected] or text/call me on 0477 200 670 and I would be happy to answer all finance related questions.

Wilson Yuan

Managing Director

Credit Representative Number is 530101 under Australia's Services Australian Credit License (ACL) 389328 © 2021 HEROES HOME LOANS AUSTRALIA PTY LTD

http://heroeshomeloans.com.au/

Go direct with banks.