Question

What is the best Australian Savings Accounts for 2024?

Making your own money is hard, so why not put your money to work for you instead?

We got some interesting results from last year's poll, and the OzBargain community's choice back then were ubank High Interest Savings Account, ING Savings Maximiser and BOQ's Future Saver.

However it seems the continual interest rate rises have pretty much stopped with the RBA deciding that 4.35 percent is the way to go for the future. Let's see which bank account takes the top spot this year.

What is a Savings account?

Savings accounts, as opposed to Transaction accounts, are high-interest bearing accounts that give you more money in return for the amount of money you put in. Savings accounts differ from Transaction accounts in one major way; they specifically discourage you to spend money by reducing the interest paid to you if you withdraw from it, but might reward you if you regularly deposit money into it.

Some Key factors to look out for when deciding on a Savings Account:

- The Interest rate, and how frequently you receive the interest

- Honeymoon periods - also known as introductory interest rates, these are short periods of time that you'll receive a higher interest than normal before it reverts to a standard interest rate.

- Minimum and Maximum account balances. Some Accounts don't pay interest if you keep too little in the account, and some won't pay you interest on balances over a certain amount.

- Account keeping fees

- What rewards you reap when you deposit in money regularly and what penalties you'll get for withdrawing money

- There may be certain requirements to fulfil before you can apply for the account (such as having a linked account)

Bank Interest Rates Spreadsheet

This spreadsheet is maintained by users on Whirlpool forums, please note the figures are not updated in real time. All credits go to the maintainers of this document. Please note that it is your own responsibility to do your own product research before opening any bank account, no-one else can be held responsible for any adverse events (or financial loss) that you may encounter through the use of this list.

How do I suggest products/providers to What Should I Buy polls?

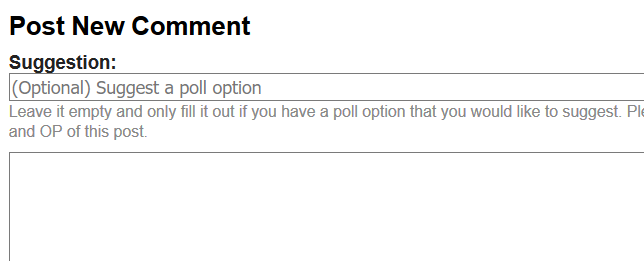

If you have a product that you would like to suggest for the poll (that is currently not in the Poll Options), you'll need to make a top-level comment (i.e. not replying someone else's comment) and type in the “Suggestions” text box just above your comment:

Do try to make a sensible suggestion and include a brief argument as to why you made this recommendation.

Westpac Life