The RBA have mmade some changes to the way banks make $$$ from credit cards including changes to rewards schemes.

Having recently received an ANZ Black, what impact will this have on my QFF rewards points collection?

I noticed they droppeed the points rate in half from 3 points to 1.5. Is it even worth having?

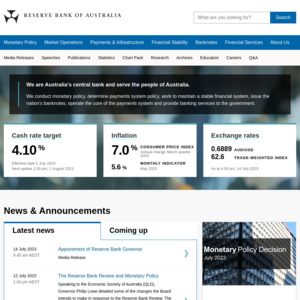

The RBA rules, which are currently being reported in the media, are different to what you are thinking.

Surcharges that some retailers charge their customers for credit card transactions will be limited to what banks actually charge. This should stop excessive credit card fees on transactions such as purchasing airline tickets. New rules come into effect on 1 Sept 2016 for large businesses and 1 Sept 2017 for smaller businesses.

The RBA cannot rule in terms of rewards schemes, I think. Banks are cutting rewards points because of a previous rule around what they can charge each other for interchange credit card fees. They make less income from charging each other. Just robbing Peter to pay Paul.