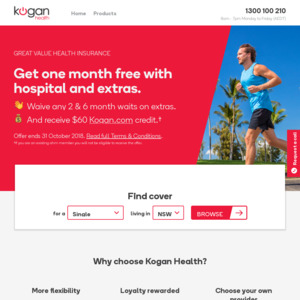

Just got an email from Kogan introducing their Private Health Insurance.

https://koganhealth.com.au/?utm_source=MailList&utm_medium=e…

I am not with any insurer at this moment and considering getting some coverage.

What do you think of their products?

Cheers

Yeah, rebadged AHM - AKA Medibank Private

https://ahm.com.au/health-insurance

Same interface, different colours … I will have to compare prices.

Read their reviews: https://www.productreview.com.au/p/ahm-australian-health-man…

I was with Medibank and they were rubbish.

It seems like Health Insurance are becoming like Utilities LOL

AAMI Health Insurance = NIB

They are all jumping on the bandwagon.