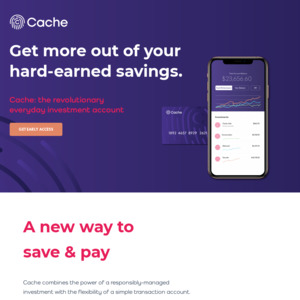

I found an interesting alternative to the usual bank term deposit and cash savings account that I thought I would share.

The website is here:

https://cacheinvest.com.au/

In summary, instead of getting a "fixed" interest from the bank, you have the option to invest your money in exchange traded funds through different risk profiles of your choosing:

- Conservative (cash potentially?)

- balance

- high growth

in hope for higher returns…

The benefit of this app:

- You can still use your money for day to day transactions

- You can partition your money (e.g. 30% cash, 60% balance, 10% high growth)

- "instant diversification", which sounds like you could change your risk profile when ever you like (speculating from wording on the website)

It will be something to look into in the future. For me, the app is quite enticing as I know that I don't have enough cash to invest myself, brokerage fees would kill my growth/profits and earning 2-3% in cash savings with the bank is…a bit sad imo.

Questions that I'm asking myself at the moment is:

- How are losses and gains realised in terms of timing

- Who is backing and running the fund

- How will the banks respond to the new platform

- What will the "conservative" growth option entail, if this can get an average of 3% for cash, this would be a strong alternative to the banks

Further information on T&C's and fee structure that are yet to be released will be something to look forward to reading.

I'm not sure what Early Access is all about. Maybe this is a strategy for funding the app from investors.

Looks similar to Raiz (formerly Acorns). There's a few others which have sprung up since.

I think general consensus is that it's good for doing small amounts on a regular basis.

But if you're investing large chunks at a time, then it's better just to buy ETFs directly, and avoid the management fees on top.

Some people do a hybrid - i.e. put small amounts into Raiz until you have a sizable chunk, then roll it into ETFs.