Do you trust Finspo with all your banking information?

The App on Google Play store only has 100 downloads (not sure about Apple), and wants all your banking details (Login and Password) for all your Banks, Credit Cards etc… I received an email in September saying thanks for joining us as I was on a waitlist, but I don't remember signing up to it.

I heard on the radio last year that someone was interviewing a financial adviser or someone from the government, and said Money Brilliant was a good choice and something else (can't remember).

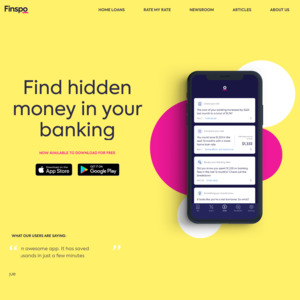

I've used Money Brilliant as it has 100,000 downloads, and it seemed safe to have it recommended on the radio, but this new company Lab35 Pty Ltd trading as Finspo (ABN 34 637 821 928) since September has started. The App says it will find hidden money, interest, credit card rates, loan rates, fees and so, across multiple banks.

What are your thoughts on this new company. I'm not willing to trust it as yet.

No way never give your banking password to anybody! Probably not even your spouse!

That reminds me of the payment system that was used in airline websites where you had to give it your banking info. Just no.