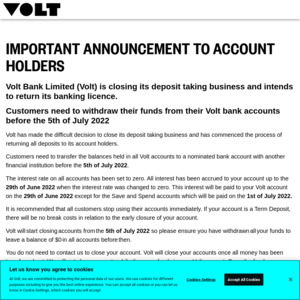

IMPORTANT ANNOUNCEMENT TO ACCOUNT HOLDERS

Volt Bank Limited (Volt) is closing its deposit taking business and intends to return its banking licence.

Customers need to withdraw their funds from their Volt bank accounts before the 5th of July 2022

Volt has made the difficult decision to close its deposit taking business and has commenced the process of returning all deposits to its account holders.

Customers need to transfer the balances held in all Volt accounts to a nominated bank account with another financial institution before the 5th of July 2022.

The interest rate on all accounts has been set to zero. All interest has been accrued to your account up to the 29th of June 2022 when the interest rate was changed to zero. This interest will be paid to your Volt account on the 29th of June 2022 except for the Save and Spend accounts which will be paid on the 1st of July 2022.

It is recommended that all customers stop using their accounts immediately. If your account is a Term Deposit, there will be no break costs in relation to the early closure of your account.

Volt will start closing accounts from the 5th of July 2022 so please ensure you have withdrawn all your funds to leave a balance of $0 in all accounts before then.

You do not need to contact us to close your account. Volt will close your accounts once all money has been transferred out. We will not close accounts while there are funds in your Volt account. Once the funds are transferred out we will issue you, via email, a final closed account statement which will provide you with a record of interest paid this financial year, for your tax records.

Your accounts are still operational, and Volt will continue to provide service to you as you transition your banking arrangements.

Volt is doing everything possible to return the deposits in an orderly and timely manner. The Australian Prudential Regulation Authority (APRA) is closely monitoring this process. In addition to this, deposits are protected under the Australian Government Financial Claims Scheme which guarantees deposits up to $250,000 per account holder. You can find out more information about the guarantee at the FCS website.

Release on https://voltbank.com.au/