I've been looking at buying some 40mm Noctua fan which are quite expensive in local PC stores.

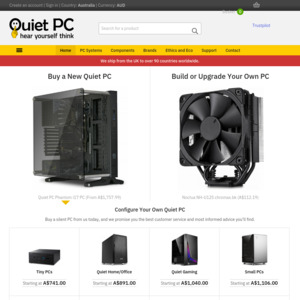

I find the website quietpc.com which is based in the UK. Prices are almost half of what can be found here with similar delivery costs.

On the site it says

Please note that your order will be shipped from the UK therefore as an international customer you will be responsible at the point of delivery for payment of any import clearance fees, taxes and duties. This is in addition to the delivery charge paid at time of ordering. Please check with your local customs office for further details.

So if I'm understanding it correctly, there's still GST on low value import that the vendor is supposed to collect but from the above statement, it doesn't sound like they do that.

Anyone know how this is supposed to work? I don't want to be hit with some unexpected fee or have to deal with any other issues

Also ask the store to not include VAT.