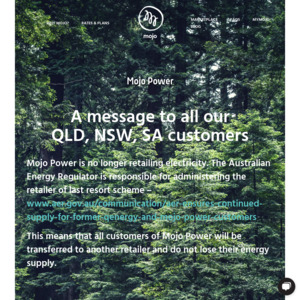

Mojo Power were forced to discontinue providing electricity to customers on 15th June 2023.

I received my final bill 26th June for approx $130.

However only 3months prior on 28th March I paid $360 for an annual energy pass.

So essentially I am owed around $285 of that (approx 9.5months)

$285 - $130 = $155 credit owed

It seems incredibly unfair that with inflation/interest rates, high electricity prices that this occurs to a family man with a wife not working looking after our 2 adolescents.

Mojo Power have now gone to liquidators and debt collectors. If I don't pay their bill despite being owed money then the debt collectors could put a bad mark on my credit rating.

Pay the bill and cut my losses or is there some form of action I could take?

I'm sure there are many others who were Mojo customers who may be in a similar situation.

Have you called them?

I wouldn't pay.