Dear Ozbargainers,

My parents have a small 2 bedroom unit that that they been renting out for years.

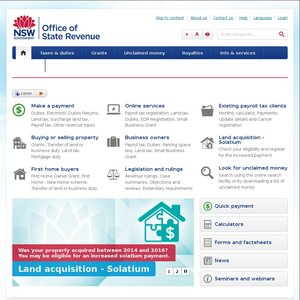

Recently they've received Land Tax Legal Notice: Payment Overdue notice from NSW OSR.

It's over $5k.

The letter issue date is March 2016

The pay due date is April 2016

The letter is written in very threatening language.

It's showing that the assessment has been done in January 2016 and it's attempting to bill my parents for tax and interest on 2011, 2012, 2013, 2014, 2015, 2016.

I believe that it's completely unfair, given that this is the first communication that my parents got from NSW OSR ever.

Has anyone experienced anything like this?

What would you recommend my parents to do?

Contact the tax office by phone on the number listed on telstra, not the one on the letter (just in case).

Talk to them and find out why this is the first they have heard of it…… BUT regardless of this is the first they have heard, the money needs to be paid.

You might be able to avoid interest charges, if you convince the tax office that they weren't aware of it.

Be polite, take written notes and listen to your options