Hello Ladies and Gents,

I think cashback rewards are great - but bitcoin rewards are better :)

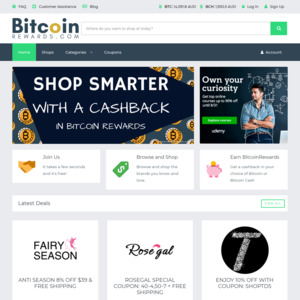

I am working on a cashback site that works extensively with Bitcoin. I'm based in Queensland and have been involved in the bitcoin scene since 2013. I want to assist in making bitcoin accessible to everyday Australians.

I believe we can help remove a barrier to entry for Australians that want access to bitcoin and other digital currencies. Essentially we plan on rewarding Australians with bitcoin for what they are already doing - shopping online.

I welcome your feedback, opinions and any questions on bitcoin and/or bitcoinrewards.com.au - please note the service has not yet launched, our devs are busy working on the development and the existing domain directs users to a waiting list so we can inform them when we launch.

Regards

Kahn

This is a good idea especially for people like myself who's into Bitcoin and other crypto, i have to thank Bitcoin and alt coins for an early retirement. Hey op, if it's like a cashrewards.com.au but paid with Bitcoin, i'm interested as i would rather receive Bitcoin as reward since it still hasn't reached it's full potential, so happy that the price of 1 Bitcoin is AUD $10,000.