G'day Team OzBargain

My wife and I are planning to refinance the mortgage for a more competitive rate. Some facts:

- Bought our PPOR in Canberra in September 2018, mortgage through a big4 bank

- Currently on 3.86% variable rate

- Our circumstances may change in the next 6 months (reference to prams, cots, nappies etc.)

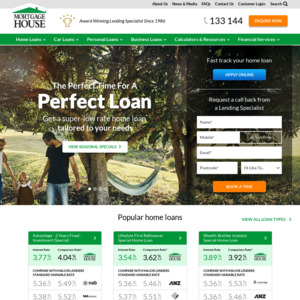

- Competitive mortgage broker has recommended Mortgage House.

Points for discussion are:

- Is it wise to refinance, given we are on 3.86% with a big4 bank (less likely to increase rates due to negative publicity etc. post banking commission findings)?

- Is Mortgage House a decent business? What is the likelihood of them increasing the rates after honey moon phase is over?

- Has anyone refinanced with Mortgage House in the last 3 years and what has been their experience?

Appreciate your time and suggestions.

https://www.mortgagehouse.com.au/mortgage/lifestyle-first-re…

Diapers? They’re called nappies here, mate.