Happy with my Tic Toc home loan rate (1.89% 2 year fixed o/o with offset).

However, the interest that I have 'offset' with my account balance isn't accessible.

In other words. if I was supposed to pay $2,000 in interest, but only $500 went to the bank, then I have effectively offset $1,500 of interest.

Question: should I be able to access/redraw that $1,500?

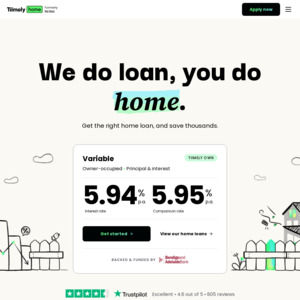

My previous banks let me. Adelaide Bank doesn't seem to… although I may be looking at my wrong?)

Huh? That's not how principal repayment works?

Are you mixing up with redraw?