Moderators at OzBargain are now running yearly polls to decide the best products in popular categories that get asked repeatedly in the forum. Our aim is to have a central thread where users can vote on the items, suggest options and also change their vote throughout the year. For more information on how these polls work, or if you want to suggest a new poll that isn't covered already, please refer to our announcement thread here.

Question

What is the best Australian Transaction Account for 2023?

Transaction accounts are a basic day-to-day use account that everyone should have: It's an account you typically use to spend money with, such as paying for basic expenses and bills.

However, these accounts can attract fees in various different forms: such as

- Monthly account keeping fees

- ATM fees (for using an ATM that belongs to another bank). Many banks however, have now ditched local ATM fees.

- Phone, or Internet banking fees

- EFTPOS and Branch fees

- Foreign transaction fees and Overseas or International ATM access fees

Some of these accounts also offer it's members benefits, such as:

- Support for contactless Mobile payment platforms such as Apple or Google Pay

- Being able to earn some interest

- Joint accounts

- Fee-free money transfers to other banks

- Ability to earn rewards points such as FlyBuys, and cashbacks

- Extra bonuses when you refer friends and family to join the same bank

Last year, most of you voted for the Up Everyday Account, followed by the Macquarie Transaction Account. ING Orange Everyday took third place.

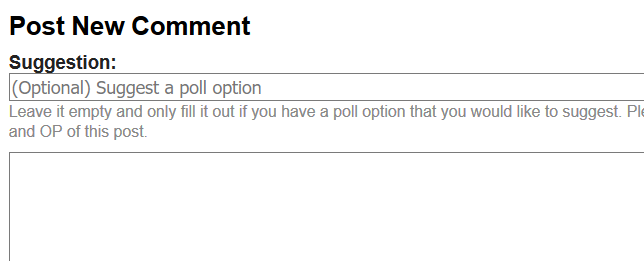

How do I suggest products/providers to What Should I Buy polls?

If you have a product that you would like to suggest for the poll (that is currently not in the Poll Options), you'll need to make a top-level comment (i.e. not replying someone else's comment) and type in the “Suggestions” text box just above your comment:

Do try to make a sensible suggestion and include a brief argument as to why you made this recommendation.

Bankwest Everday Transaction Account: A great allrounder