First post.

Been hunting for the next card for reward points. The highest extra points was as high as 300,000 MR points on The American Express® Platinum Card, but that last year.

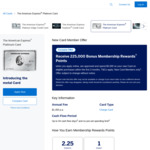

Recently saw an ad that has 225,000 bonus MR points instead of the typical 150,000 MR points. It disappeared ever since I clicked into the page.

If you go into it as per normal, it will show only 150,000 MR Points offer.

Searching on google "The American Express® Platinum Card 225000 points" can easily bring the page for the 225,000 bonus MR points offer.

- $1,450 annual Card Fee

- Receive $450 Travel Credit each year

- Platinum Travel Benefits including travel insurance

- Purchase Protection including product warranty extension and stolen or damaged product coverage

- 2.25 Points per $1 spent on purchases excluding Government bodies in Australia

When did they offer the upgrade? After how long?