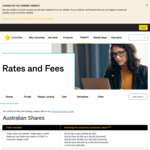

I know it is still expensive when compared to other platforms but still better than paying $20 per transaction for up to $1000 worth of stock.

Buy it, invest it, re-invest it or sell it - harder better faster stronger. It if is a duplicate post, please delete it.

Free with CMC Markets up to $1000.

The Comsec user interface isn't really anything to write home about and is actually quite outdated, not worth the extra costs.