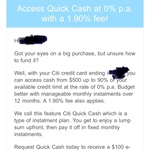

Got this in my email, possibly targeted but I already have used the Citi FPO (fixed payment option) plus gift card from the previous offer and have still got this offer.

Basically, if you have a Citi credit card, you can convert it into cash, up to 90% of your credit limit and pay it off in 12 equal monthly instalments at 0%. (One off FPO set up fee of 1.9%)

Plus if you get an FPO for over $1000 then you will automatically get a $100 Coles, Myer, Bunnings or Amazon gift card. So for a $1001 FPO it means $19 in fees plus $100 gift card plus you get to use the $1000 for free for a year with no interest.

$80 free money 😀 👍

Note: Please use caution while taking up any such offers as any missed payments may lead to hefty charges and negate the $80 benefit very quickly.

Hope this helps some of us

Enjoy !

Yup got this one too. it's 4th citibank offer I took for the last a few months yet haven't got any GC tho. :/