Hi All,

Wanted to offer a deal to OzBargain members.

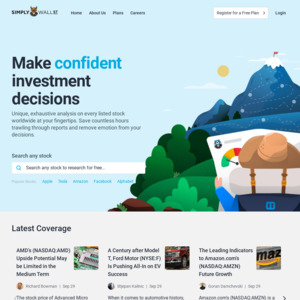

Simply Wall St turns you into a better investor by helping you make non emotional long term investment decisions on high quality stocks. We do this by turning complicated financial data into simple to understand visuals.

We currently cover over 15,000 stocks on the Australian, US and UK markets.You can also visualise your portfolio.

There is a free version available however for those heavy users of the web app we are currently offering 66% off your annual subscription for a limited time.

Thanks

Simply Wall St Team

Honestly the biggest red flag I see being waved around on services like this is when they use the label "high quality stock".