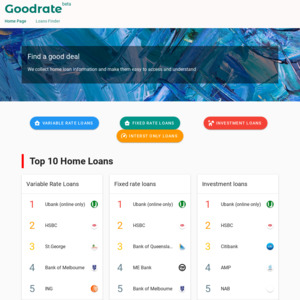

I've relaunched the home loan comparison to rank top 10 home loans. The website name is called Goodrate.

Webpage: https://goodrate.com.au/ or https://goodrate.web.app/

We use algorithm to sort through thousands of home loans, and categorise them into much easier to read summary. For example as at today:

- Ubank - 2.84%

- HSBC - 2.90%

- St George - 2.94%

- Bank of Melbourne - 2.94%

- Bank SA - 2.99%

- ING - 2.99%

- AMP - 3.02%

- Citibank - 3.08%

- NAB - 3.09%

- Macquarie - 3.09%

I'll be adding local mortgage broker finder in my next release for people to enquire for pre-negotiated deals that might not be advertised on banks' website.

I'm looking forward to your feedback to tell me what other useful features you like to add to the wish list.

Cheers

Sam

Need way more info than just the interest rate.

Also the link is blocked from my work PC so I don't trust it much.