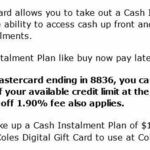

Sounds like a no brain deal, where you can convert $1000 to 12 months payment plan and receive $100 gift card by paying $19 one-off fee.

What's the catch on this?

Once i received my gift card, can i Pay $1000 off straight away?

Coles Credit Card is issued by Citigroup. See also: Citi Quick Cash: 12-Month Interest Free (Bonus $100 Gift Card with $1000+ Cash Advance), 1.90% Setup Fee @ Citi.

yes