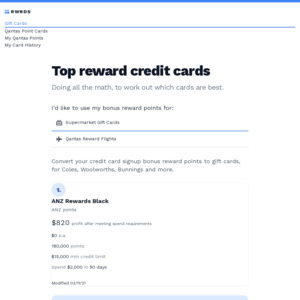

I used to do credit card churning for Qantas points, so I could redeem it for flights, but since the pandemic, there didn't seem much point. So I started doing it for Coles/Woolies gift cards, to pay for my groceries.

I looked at all the existing sites like Finder and Creditcard.com.au and they will tell me the points and the annual fee, but I had to manually work out how much I will get back in gift cards after I get the sign up bonus, pay the annual fee, look at each bank's rewards program cost to get a gift card etc.

So I decided to make a site myself - https://www.rwrds.com.au/

It's just pulling from a spreadsheet I made to track which credit card I get next. Anyway, love to get peoples thoughts about what I can add to make it better. Literally just put this together in a couple of days.

Update: Added an individual page for each card, I'll put more information on this page - like the minimum credit limit etc

Update 26/5/21: Whoops! Didn't know I was not allowed to comment links to my site on deals? So those 3 comments are now deleted. I guess I'll just post the info in the comments here for credit cards?

Update 30/5/21: Adding a dedicated page for people wanting to do Qantas/OneWorld Round the world, instead of using the points for gift cards https://www.rwrds.com.au/qantas/round-the-world/business

Update 7/6/21: Bought the domain rwrds.com.au for the site. Got to ask the mods to change the domain in the associated page now.

I think the only issue is that the offers and value might keep changing. I normally suss out new cards via point hacks website and decide from there if I want to go ahead with it.

Also have to keep in mind different cards may have different income requirements, so there is no 'one size fits all' approach.

The layout looks simple and easy to read though