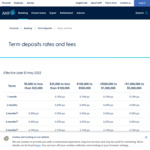

At the moment, AMP Bank is offering the highest 5 year term deposit for a minimum of $25,000 for 4.15% p.a. If you have a minimum of $5,000, it will be 4.1% p.a for 5 years term. Not a bad offering considering current online savings account rate is less than 2%. Interest paid at maturity.

5-Year Term Deposit: 4.15% p.a Minimum $25,000 Deposit, 4.10% p.a. Minimum $5,000 Deposit @ AMP Bank

Related Stores

closed Comments

- 1

- 2

yeah I also had same experience. I created a saving account, deposit money in and then they locked it straight away. I called them 100+ times and for around 3 month until it's finally unlocked. The support kept saying my issue is with another team that has no contact and no turn around time and there's nothing they can do, during this time I had to sell lots of personal belongings in order to pay bills. definitely avoid them. If you go to product review.com.au and you can see how many people has issue with them

I was about to say, who the hell would trust AMP with money? Total scumbags.

I had $3000 of super with them which came to $2000 on withdrawl 15 years later, thanks to fees.

Not joking.

Same issue here with Super.

Never, ever again would I have anything to do with AMP.

Thank you! The only scums to surpass Hardly Normal. I fell for a Bettr3 Account, they managed to scam me with over $300 of drip fees.

Their deceptive game is back!

Limited by age and rate is variable plus have to transfer $1000/month though can be withdrawn afterwards.

And up to 50k only. Anything over is just 0.8% lol

Thanks for this. Might take a look into it

Bunch of age'ists

Thanks for this mate! I'll be moving some of my savings here.

Only for under 35 years of age

Only for Gen Z.

What??? 35 year age limit?? Do I have to supply a hormone test?

A common belief is 'you can't beat the banks / they're full of smart people with computers / etc'. But sometimes it is possible to beat them.

In early 2009 I opened a 7.25% 5 year term deposit with Rabobank. I saw rates heading lower and managed to snag a really good offer. Missed getting the peak 7.5% by about a week. Rates continued to fall and I was getting more on my TD 2010 onwards, after tax, than I was paying on a mortgage.

Having said that, the current trend is up. AMP is betting funding costs will average more than 4.15% over the next five years, so they're counting on the RBA raising rates at least 8 more times.

Could 4.15% be a good offer? Sure. If the world falls into depression and reserve banks are forced to slash rates below 0% again (Europe already did so) instead of continuing the current upward trajectory.

I work at a bank. Definitely not full of smart people. We do have a few computers though.

Also Macquarie Bank gives 1% interest on online savings account

Spend all your hard earned! You are a long time dead!

All of this shit is just criminal. I suppose it's still better than rest of them "crooks in suits" giving us 0.1 - 0.2%

Gotta remind yourself the official CPI is at 5.1%, if you had a balance of $100k sitting in a bank account, over 5yrs period with current inflation, you'll lose roughly 22% of your purchasing power.

You'll be crazy to leave your hard earned money with the banks.

The other way to look at it is if you're borrowing money you're basically using it for free. Get a home loan at 2.5% while inflation is running at 5%.

How do you think the banks make money? They loan out at a higher rate than they pay.

so does it mean it is better than most offset account?

4.15-0.5=3.65% (but our income tax is 30% so it is 3.65*0.7=2.6%)

The term deposit pays interest yearly but home loan charges it monthly so you need to account for that. Also make sure you are including the Medicare levy in your tax calculation.

You might be slightly better off for a few months until your home loan interest rate increases or AMP change the penalty amount.

Here is a crazy prediction: interest rates will go up slightly no more than 1.5% over the next few months and in 12 - 18 months financial system will implode. We will all be staring down a depression as we are already teetering on a recession. Interest rates will come down again and will possibly go negative to combat incoming depression; stimulus packages will be released by the government causing higher inflation. APRA will use the amended 'bail-in' laws to utilise everyone's hard earned savings in bank accounts to save the banks from going bankrupt where you will potentially lose part or all of your savings. Big call but we will soon see. Not financial advice.

defo a depression is in the very near future, agree on that

and people are already crying over a 0.25% rate rise

Govt guarantee on deposits up to 250K per institution. What are you talking about?

At the gov discretion

Only if bank goes bankrupt, they can leach you money prior to this and stay afloat. Gov garuntee never factors.

I think there might be a bit of exaggeration in your statement. Maybe a recession, but with unemployment at records low and a steady financial dollar (unless handout haven Labor get in) then Australia might skim the top of that curve.

However if Labor get in, then yes we are doomed.

I guess with your heavy prediction, what’s your amazing financial investing solution?

There is a catch buried in the fine print, the interest rate adjustments for early withdrawals can be changed by AMP with 30 days notice. However, for early withdrawals you have to give 31 days notice. Doesn't look like the interest rate adjustments have been increased recently, while the term deposit rates have.

They won't tell you how they calculate it unless you already have existing TD. I think it's a trap.

Open one for a dollar then ring them up

5yrs is a loooonnggg timee

even a lot longer if we get Comrade Xi to advice Canberra!

I don't trust banks. I will trust an unemployed dude from the Phillipines running BeOS for his defi project before a bank.

The last time Australians lost money due to a bank collapse was during the Great Depression.

The last time Australians lost money due to a crypto collapse was last week (UST/Luna).

I rest my case.

Did any private saver lose money? Straight from your link: " As a government-owned bank, deposits were guaranteed (legally underwritten) by the Government of South Australia."

@muncan: Sure did, and the money lost went, well, who knows where. Part of it would have gone to wages and paid into the tax pool though…

It's this compounding?

no, you get the interest annually, unless you select a different cycle but it doesn't get reinvested

4% locked away for 5 years haha what a waste

Maybe do 3.6% for two years then lock in 18% for a further five years.

If banks are offering a rate to lock your money away it means they predict interest rates will rise, they win you lose.

Do the opposite of what banks want you to do they only care about themselves and shareholders

CBA advertised one yesterday, 2.25 for 18 months from memory, which seemed ok from a big 4 crook.

Is putting extra money in super a better option if you know nothing about investing or what's going on with the economy?

Yes. The tax savings and long term compounding will easily beat any term deposit. You need to take control of how your super is invested though, if it's with AMP you could be in trouble. You can't get to it until you're in retirement phase though.

And learn a bit about investing and the economy, its not that hard.

Not a bad offering considering current online savings account rate is

I'll say is a very poor offer.

As stated before interest rates may/will change and after 5 years who knows what they will be.

The worst aspect is your money will be "frozen" (captive) for 5 years and opportunities may appear for those with abundant cash.

In particular if inflation blows out.So, categorically, not a good offer.

Hey, for a reason AMP offers this, because they will make a lot more out of it. Which is understandable.

For 5 years yes very poor but for the shorter terms is ok over current HISA rates.

The worst aspect is your money will be "frozen" (captive) for 5 years and opportunities may appear for those with abundant cash.

No.

You can withdraw the money whenever you like, with some interest penalties - if better opportunities appear then go ahead and withdraw !

You can withdraw the money whenever you like, with some interest penalties - if better opportunities appear then go ahead and withdraw !

Yes I know, they all do.

But if interest is already "poor" and then have to pay penalties to withdraw, why to invest there at all?

A common "Investment Account" will pay less but will take less (zero!) if funds are needed.As always with finances: it is a personal decision.

5-Year Term Deposit:

5Y is a long time for such a low return.

4.15% p.a

CPI is 5.1% and inflation is +15.0%.

So thinking of depositing for 5 months at 2.15%, but just not sure, thinking maybe interest rates might go up to 4-5% in the next couple months but just don’t want to miss out

Hedge your bets. 50% @ 5y, 50% @ 5m

Then you’ll be only half as worse/better off.

Well interest rates have gone down for 5 month to 1.90 and as effective 30 May.

How long does it take to open a term deposit account ? It’s been a couple of days already and nothing has happened ?

Should be within few days, maybe give them up to 5 days.

I opened 8 months term deposit at 2.5% I’m thinking maybe to change it to 2 years at 3.65% but hesistant waiting that long.

What did u all do?

For 8 months at 2.5% I would just let it be in ING savings account @2.1% without any lock in

I applied Tuesday night and got my account opened on Thursday.

Account is now opened up all good.

I have 7 days grace period to pull out of amp which ends Friday.

Not sure what to do as maybe interest might be better ? Or maybe extend for

2 years and pull out with penalties ? So confusing because it’s scary to be locked in.

Any one have opinions ?

With the more recent RBA increase, I wonder if we will see better term deposit rates than what is being offered here by AMP?

Probably when the next rate increase ?

You would hope so, but only if they decide to pass it on. The most recent 0.5% increase resulted in zero change to term deposit interest rates!

Bump x2

If anyone needs to terminate their AMP term deposit early (eg. given the increased availability of better interest rates), note that you’ve got until the end of July to do so at the previously advertised early withdrawal penalties.

From 1 Aug onwards the penalty for early withdrawal is much more severe.

https://www.amp.com.au/content/dam/amp/digitalhub/common/Doc…

Everyone knew this was coming. So now you're getting only 1.4%. I wonder if they gave you enough time to get your money out

- 1

- 2

Gov guarantee has nothing to do with ease-of-access/withdrawal of funds…