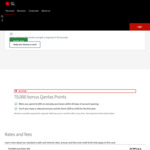

NAB is offering an increased signup bonus of 70,000 Qantas Points.

Pro-rata refund available

Details include:

- Receive 70,000 Qantas Points when you spend $2,000 within the first 60 days from approval.

- Access to 6 complimentary insurances when you make an eligible purchase

- Earn 1 Qantas Point per $1.50 spent on eligible purchases up to $3,000 per statement period, then 1 Qantas Point per $3 spent on eligible purchases from $3,001 to $6,000.

- An additional bonus 1 Qantas Point is earned per $1 spent on Qantas products and services, such as flights and Qantas Club membership.

Offer unavailable to existing NAB cardholders, if closing/transferring from another NAB credit card account or to those who have held a NAB-issued credit card within the last 12 months 18 months.

@Unacceptable: Don't go with GCs, take a credit refund instead, better value ($600 credit vs $500 cards)