Currently about to come off a fixed term mortgage with Comm bank and I'm looking to get the best deal on a variable rate. I have come across Tic Toc in my searches and would like to get some feed back from current customers. Pros and Cons.

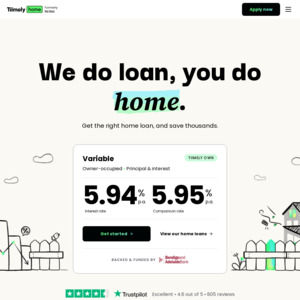

Their advertised rates appear to be about 1% less than any deal I can get with Comm bank.

TIA

Pro - good rates

Con - decreases attention spans and encourages negative comparison