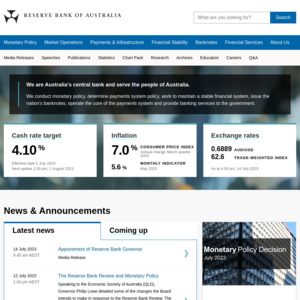

In a massive shake up the RBA Governor Philip Lowe will not be given another term and will be replaced by Michele Bullock. Michele Bullock named as next RBA Governor, Philip Lowe’s term comes to an end

I have been critical of Lowe in recent years but the governor of the RBA is probably the most important job in the nation from an economic stand point. Now I'm not a fan of Lowe but on reflection I kind of feel him being given the boot is a 'bit harsh'.

He has had no choice but to up interest rates to try bring inflation down and as someone with a home loan I'm not a fan of the blunt tool the RBA uses in rate rises to slow the economy but it is the 'only' tool they have. Really it is the appointed political leaders who need to be held to account for not managing the economy better (pervious Josh Frydberg currently Jim Chalmers)

I'm sure Michele Bullock will be a fine replacement (likely/maybe even better than Lowe) I couldn't care less that she is a women we live in 2023 and find it a bit strange our PM and Treasurer think that is something that needs to be announced.

She clearly has the CV to lead the RBA and got there on merit mentioning she is a women cheapens the appointment - in my opinion she has gotten the job on merit.

Regardless do people think Lowe deserved the sack, is it fair enough we bring someone new in? Given the circumstances no one else in the world has managed monetary policy much better or worse so what else could Lowe do?

I'm in two minds I understand the change but perhaps it is a tad harsh.

Movable GST would be fairest, the biggest spenders pay the most.