It's that time again, last month we had 68.8% predict it would go up, 29.6% that it would hold still, and 1.6% that it would go down.

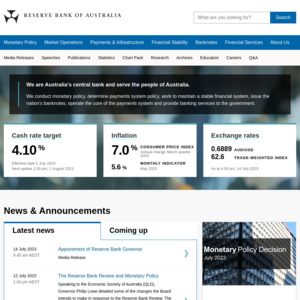

Let's give it another go, What do you think it's going to be for the RBA's announcement for 01/08/2023

Get your guesses in by 31/07/2023

HODL