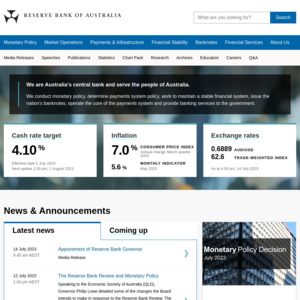

Both Unemployment being lower then expected and CPI being significantly higher then forecasted has most likely left the RBA in the blunt tool position of upping rates in my opinion.

Regardless the question needs to be asked what do you think our RBA chef Michele Bullock will do in November?

personally speaking i cant see how they dont rise the cash rate meaning more pain for borrowers the question is about how hard they rise…..

The other question needs to be asked despite the rises hurting borrowers they are 'also' helping savers which is somewhat inflationary as those who are 'cash rich' (many older Australians without debt) are benefiting and spending more…..do we need to look at a different way to battle inflation ie increase mandatory super (temporarily) to reduce the bulk of workers 'take home pay' ?

Michele will raise it and will then hold in December to make herself look like she's our saviour.