Was telling my mate he'd never retire at 30 unless he started planning early and saw this sheet was on sale

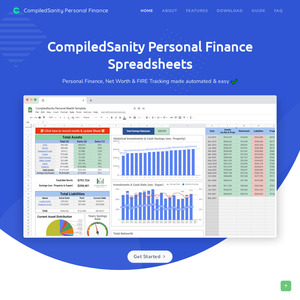

Decent sheet with lots of features like live networth tracking and savings goals

If you're a casual AusFinance user or a chad FIAustralia enjoyer you'll recognise this sheet

EDIT: Quick plug for FIAustralia, where hard hitting financial questions are answered, like this:

https://www.reddit.com/r/fiaustralia/comments/o89r51/should_…

I've never used this so can't compare, but if anyone is after a free envelope budgeting spreadsheet (similar to YNAB) I'd highly recommend Aspire Budgeting. Been using it for 1.5 years now.