A rise after 11 years. Interesting times. How will OzBargainers be affected by this? Keen to hear your thoughts.

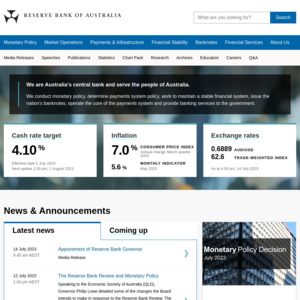

RBA Raises Interest Rates by 25 Basis Points

Related Stores

Comments

um the big 4 have all passed on the 0.25% increase, almost within minutes of the RBA announcement

I'm expecting that we're probably going to see multiple rate increases over the next year or 2. I more meant that I'm interested to see what they do along those increases.

family dinner out this weekend = CANCELLED !

In NSW perhaps.

In Vic, we now schedule our family dining out to be between Mon - Thurs and collect our 25% rebate from the Vic government.

Is that still on? People must be too poor to go out even with 25% discount.

collect our 25% rebate from the Vic government.

Wait, what is this?

https://www.ozbargain.com.au/node/684377?page=1#comment-1207…

Ignore the 'expired' tag. The Dining Program and the Entertainment Program both have $$$$ left to be claimed.

The Australien Government (at Juice Media) have nailed it once again ….

Those greens tools in disguise as comedians? No thanks.

I see the greens army is here lol

The same greens army responsible for scuttling the cprs and setting climate action back at least 15 years

@Vote for Pedro: yeah too many of those pesky "wokies" are downvoting you for telling it how it is!

a vote for Labor is a vote for Greens.

/s

@Griffindinho: Lol labor voter dislike the greens more than they dislike moderate Libs.

The greens are just tree tories while the libs are beholden to the nats and one nation.

You must be living in fairy land

@Griffindinho: Bandt is the biggest yuppie tree tory there is.

Still, imagine being a lib and being in bed with racists, bigots and rednecks.

I am glad, some parts of the economy have been going bonkers with near zero interest rates and there are bad skills shortages. The land development industry in particular would benefit from a slowdown to resolve bottlenecks from skills shortages and reduce prices for construction inputs.

In terms of a mortgage it's not as bad as it seems. Because we have high inflation accompanying higher rates, and that inflation will eat away at the value of your loan. It is like making extra repayments that are forced.

It is of course bad for those who are barely able to make their repayments as it is, I keep reading stories about that and wonder why the banks were so irresponsible in making those loans. The lessons from the royal commission are truly dead and buried.

No affect initially, it may take some heat out of the property market as people may give more thought to future rate rises. But a 25 point rise is very small in the scheme of things, if you cant find an extra few dollars in your budget then I dont know what to say.

Those living in Reid and Fiona Martin, sounds like a nut job she is …. yes I know it's not a peer reviewed source but ffs what's with these selfish prick Liberals

Next senseless purchase via Ozbargain = CANCELLED !!

Got to love how when cash rate went down banks were all like “nah RBA cash rate is only part of the picture” and only passed on a percentage of decrease. When rates go up on the other hand…

So exactly like petrol prices then?

?

Was thinking that exact thing during the news today. Exactly like the gas stations except pumping money :P

I'm not an economist but I think house prices will just stay flat or may go down slightly but we will not see a massive drop like everyone is wishing for.

The person selling the house will hold off if they can afford to (increasing rent is one for investors). If they can't then it's up to the demand.

The person buying (demand) will either paying more interest to the bank and borrowing less or paying more rent (because the landlord will increase the rent to cover for the rise in interest rate).

So overall the buyers don't really have a choice, either paying more rent or paying more interest and/or can't borrow as much to buy the house they want. All else equal they would rather pay more interest than rent (rent is dead money) and therefore FOMO will still be relevant.

Plus overseas buyers will be coming back, rental prices are already rocketing so pushing more people into buying. If they think they can wait for the house to drop then they will likely miss out on the dream property they want or having their borrowing capacity reduced in the future.

If they can't then it's up to the demand.

That's the point. People will not be able to borrow as much as before, so that reduces the prices. If you have a deposit of $200k, and previously bank would borrow you $500k, now they might borrow you only $300k, so the most expensive property you might be able to afford is $500k instead of $700k.

That's the only reason why prices went up in last two years. People could borrow more money.

yes but there will always be someone else who earns more/can borrow more/has more cash than you. Are you confident to sit back and wait for your dream house to drop in price because you think no one else will pay more than you? It's like the stock market trying to time it is impossible and it could turn around and go up any moment then you will miss out.

No, their borrowing capacity will also be lower.

Since house prices are all set by the latest sale and current demand, prices can plummet.

Eg 200 houses in a street all worth a million.

One sells for 800000 they are all worth 800000, especially now that the banks will only lend 800000 due to interest rate rises limiting borrowing capacity.

It doesn't matter if you sell and crystallise any gains or losses, the value is what the market says it is.

Prices can remain flat for a very long time, as they did several years ago, at which point you can consider that a correction, as wages catch up. The thing that will affect prices is how many people are buying at the same time. If buyers can hold off as long as they can, we all win (except people who bought at the peak) because supply can catch up with demand, and prices will stall or fall.

Rate continued downward in the period that you have mentioned.

Many are thinking this will be "flat", and those are the ones have no experienced any sort of modest rate increase - 5%.

The last 24 months, the amount of people maxed out their borrowing capacity won't have a good time. 80-95% LVR.

Time will tell. Same as those 12 months ago arguing housing market will not cool down because of demand. And they have forgotten that demand is highly correlated to borrowing cost/affordability.

My cash is ready. Looking forward to picking up bargains from distressed sellers. I predict some pain will really hit the blue chip Sydney market in approx. 6 months.

this may sound crazy, but imagine rates went sky high AND property prices increased alongside them. never say never…

It does sound crazy.

It's about time that the rates started to rise so the banks can start to pay decent interest on savings that people have worked hard to save.

I work hard to save for my mortgage. Does a person who holds money in a bank account a harder worker than me?

Yes actually they have worked hard for 40-50 years paid off their mortgage (when interest rate on borrowings were up to 18.9%) then saved for retirement only to get a pittance on their savings as the Government picks their deeming rate out of their @#$%.

The first $53,600 of your financial assets has the deemed rate of 0.25 per cent applied. Anything over $53,600 is deemed to earn 2.25 per cent.

when interest rate on borrowings were up to 18.9%

Ahhh when Boomers use this argument. It was such a flash in the pan moment and they make it sound like they lived through a decade of rates that high! Plus earning to house cost ratio was 3 or 4 to 1, so you know, you could actually wear the cost.

Also if you paid off your mortgage in the 90s the savings you should have made from the last 25 years should mean you shouldn't be on any pension.

@serpserpserp: They also forgot to mention the incredibly high wages - the interest rates were less the issue, and so more the liquidity to withstand the rate increases before the (normally twice) annual wage increase normalised it.

Yes it must have been hard to have such a high interest rate on your $10,000 home loan for that 2-bedroom house. :| Must have taken like what, 5 years to pay back?? Crazy!

@DingoBilly: Don't be a dick, the average wage when house prices were $10k was something like $40 a week.

Money in a saving account is for people who dont know how to invest / are lazy

so if i gave u 500k today you invest all in one day? or DCA over a year or 2, and in the mean time whilst doing the DCA where are you holding? in you a$$ or a bank account/TD

$5,000 DCA every week.

The rest hodl in DeFi collecting yield at +18.0% APY.

@rektrading: why not just keep in ur 18% account.

the way you talk you shuld be the richest man in the world.you can borrow unlimited money at 1% and earn 18% per year, how are you not as rich as Warren Buffet?

you honestly talk non stop waffle

go borrow 1 million at 1% and earn 18% and show me the balance 365 days from now

👍 +1

savings that people have worked hard to save

What about the ones that banked free $$$ from the COVID support funds for doing nothing?

Hoping for rates to normalise within the 2-3% range and for some housing speculators to get burnt.

I'm expecting more deals on instant noodles for Ozbargainers…

Im waiting on the sidelines with boatloads of cash. Rates 15% ahead IMO

Im glad OzBargain exists for people with no idea to throw ideas around, no matter how stupid

Given your assumption, I bet your "boatloads of cash" is probs whatever someone will buy you holden ss Commodore for

Why basis points? Why not 0.25%? No-one knows what a basis point is?

I agree - everyone understands a 0.25% increase. Why invent words that none of the general population uses when you can use something that actually reflects what is happening?

Because the more confusing/difficult it is for the general population to understand the better it is for the ones who are in charge.

The use of BPS as a measurement standard is less confusing than a percentage.

Where Does the Term Basis Point Come From?

The origins of the term basis point come from the term “basis”, which refers to the difference (or “spread”) between two interest rates. Oftentimes, traders will refer to basis points when describing the change in one instrument relative to another, such as when comparing the yield on a corporate bond against the interest rate offered on Treasury securities. Basis points are also commonly used when comparing the management expense ratios (MERs) of competing investment products.

You're joking, right? I didn't understand a word you posted?

either did he, he just copied from wikipedia

@Donaldhump: Clearly it is not the right audience. We only refer it to as bps or bips at work.

Not sure if it is due to quoting the incorrect % will have significant impact and quoting in % is more prone to mishearing.

Imaging mishearing .05% as .5% for 100M bond… Alot harder between 5 and 50.

America raising in 50 basis point increments.

We will surely need to follow

Yes the banks need a few more billions of profit …

Profit is 👍.

Banks have been raking in unprecedented profits even with historically low interest rates. The people who facilitated this are the people who borrowed boatloads of cash while prices were at an historical high.

Having said that, banks shouldn't be allowed to keep any profit at all. They provide an essential public service. They should be financially equivalent to a public library. And all they do is manipulate numbers and dish out loans. They can be replaced with AI.

Imagine if all the Australian money sucked into bank profits had been instead allocated to productive industries, affordable housing, or health/education.

They can be replaced with AI.

Code is law.

They provide an essential public service

Same with doctors, tradies, supermarkets, hospitals, energy providers, and NBN/telcos. Yep, no one should be allowed to profit.

Banks providing a safe place to deposit your hard earned is probably the only essential public service they provide? Borrowing money is not an essential service.

BTW - the banks redistribute most of their profit to shareholders, the biggest such ones are the superannuation funds that most Australians are a part of.

Hi frens,

The Fed raised interest rates by a half percentage point and approved plans to start shrinking its bond portfolio https://t.co/IeFndGFelO

Enjoy.

It's crazy to talk about STRESS when it's only 0.25% increase. These people should never have bought in the first place because they can't afford to.

Interest rate was at historic record low 0.1% and had not risen for 12 years. Do these people expect it to be that low for another 12 years? A quick Google search on the average Australian interest rate results "Interest Rate in Australia averaged 3.89 percent from 1990 until 2022, reaching an all time high of 17.50 percent in January of 1990 and a record low of 0.10 percent in November of 2020."

The US interest rate is expected to keep rising to around 3% over the rest of 2022. Australia won't be any different. Buckle up boys and girls, it's gonna be a bumpy ride.

I'm not sure anyone expected it to stay flat for 12 years, but the RBA did forecast it wouldn't move until 2024. Being that the RBA is the one in charge of interest rates, many took this as a guarantee of sorts despite that not being what it was.

It is a shame though because that would have given many buyers confidence to overstretch with the plan to have increased their income before interest rate rises hit.

For what it is worth though (not much, I'm not an economist), I can't see the rates making it to more than 2% by the end of the year. With Australia so over-leveraged interest rate rises will pull spending out of the economy extremely quickly. If the aim is to slow inflation, I think that will happen with a smaller rise than the market has priced in.

The RBA should be tried in a court, charged with deliberately creating a housing crisis for Australian people. Homeless people and struggling renters all across Australia should be able to sue the RBA for billions of dollars.

Homeless people and struggling renters all across Australia should be able to sue the RBA for billions of dollars.

The RBA doesn't have any money.

The taxpayers would be one that will have to foot the bill in a lawsuit.

Don't think RBA's Lowe can be sued, just like poorly performing public servants in government and councils are unfortunately not held liable for their poor performance.

Are you being for real?

@serpserpserp: The RBA chair and board probably own multiple properties each. This means they no doubt massively increased their wealth from the recent property boom that was facilitated by their decision to keep rates lower than necessary for longer than was necessary. They should be sued, or at least their conflicts of interest should be made public and discussed in a court.

@ForkSnorter: im also sure many pollies and elites offloaded their properties at the top, whilst the avg joe/jane bought the top

@tonka: These decisions should be made by people without a conflict of interest, i.e. people who will not profit more than a person on median income (which is very low, much lower than the average full-time salary)

@ForkSnorter: People on median income are NOT financially educated enough to make financial policies that can affect the economy.

@rektrading: Yeah I didn't say they should be on median income. I just meant the people who make these decisions should not own more than one property.

@rektrading: I don't know. I just know it is fundamentally unfair for the decisions that affect property prices to be made by politicians and bankers who own multiple properties in a country that suffers a shortage of houses. The government has clearly implemented policies designed to increase property prices and create more demand for investment properties among the wealthy.

@ForkSnorter: There is also a good argument that people shouldn't manage something where they don't have skin in the game. Unfortunately you are proposing a utopian solution that we are a long long way from. I kinda like the current RBA guy. It is so very rare to hear anyone in power talk about stagnant wage growth being a problem that needs to be fixed.

@ForkSnorter: Why would an intelligent and ambitious person pursue a job where they are prevented from being personally successful.

Unless by some miracle the best person for the job is also someone driven to forgo any personal wealth and remain oblivious to the assets of family and friends.This is one of the reason our politicians are all such duds.

Rates may rise but many people don’t really are.

Still splurging big bucks on overpriced GPUs, exotic cars, travel and property.

The money is flowing like champagne but still the underprivileged are suffering.

Still splurging big bucks on overpriced GPUs,

GPUs are an investment.

yes bought on credit.

The SPX fell off a cliff.

Now let's see the XJO get rekt.

How is bitcoin going the last 24 hours, 6 months and 12 months?

I'm happy when it dips because I can buy the same pristine hard asset at a discount. I bought the dip yesterday and will buy more today when I get paid.

BTFD #Bitcoin

btw Thanks for bringing Bitcoin into the discussion. It gives me the opportunity to reply.

It's a glorious start to the XJO.

-2.19% in the first hour of trading.

We ain't seen nothing yet!

Bring back the brrrrrrrrrrrrrrr!!!

I am worried how bitcoin will fare with tightening of money, it has never seen it before and it is quite possible it implodes as the money supply dries up.

I am in hard assets at the moment, at least they hold some value, even if they will tank hard in real terms like most things will.

@mdavant: Fiat 💵 outflow from one market can't hide and have to go somewhere.

The smart 💵 will 👀 for asymmetric bets that ain't affected so heavily by cash rate hikes and dwindling profits.

This is what happens when people buy 💩 coins thinking it has value because it as a product, customers, cash flow, revenue and all that other stuff.

https://twitter.com/WSBChairman/status/1522651231960932352

Expect more to come. The US Fed raised rates by 50 points. So the next meeting expect a 3/4% rise at the minimum.

nice

Then we must follow suit.

I'd hate to be heavily geared into property.

3 of the big 4 immediately announced they would apply the full rate increase to mortgages yesterday and NAB announced today they'd do the exact same, no need to wait very long to see what they'd all do. No comment on any changes to savings rates for CBA and ANZ while NAB and Westpac say they will increase them on certain savings accounts