A rise after 11 years. Interesting times. How will OzBargainers be affected by this? Keen to hear your thoughts.

RBA Raises Interest Rates by 25 Basis Points

Related Stores

Comments

Agree. Anyone that is faced with "financial ruin" over another $60 a month in mortgage repayments is just kidding themselves.

The number of people this would actually be true for is effectively zero. A lot of other dominos would have had to fall to reach that point.

Anyone who claims this as the case, may as well say they are facing financial ruin because they left their wallet on the train.

People face financial ruin every day, without even a rate rise. $60 a month will definitely effect some people already under major financial stress.

It isn't the RBA interest rate rise that is the issue.

It is the interest rate rise that will be applied by home lenders that we need to look at.

Dont care.

I'm only a year from paying off my mortgage, but we are about to sell and upgrade, higher interest rates plus housing rises in last 2 years means we will have to lower expectations a little.

you maybe better off, if housing prices halve for example, you will be able to upgrade for half the difference as before and pay less stamp duty. Assuming the rates dont increase too crazy and you can pay off the excess in a timely fashoin you will be ahead (assuming you keep you job which some wont)

House prices aren’t halving

Upgrading you tend to be better off (unless you are upgrading by simply pushing your financial limits). A 10% drop in prices will reduce the upgrade cost, e.g. if you are in a 1 million dollar home and upgrading to 1.5 million dollar home an across the board drop of 10 percent would see you at least 50k better off (plus reduced stamp duty etc). In effect you are funding the difference which will reduce.

But they will also get less for their house? So they will be no better off?

10% of a million is less than 10% of one and a half million

@algy: Yeah my point was more that it doesn't make much difference when talking about a house that expensive. It's only 50k. Better. Which isn't much in 1.35 million home

math is hard!

It's going to be bumpy

(Especially in Melbourne and Sydney)Funny thing is the 'experts' who were saying property is a safe space will all suddenly go quiet and reverse their rhetoric.

Domain and Realestate.com have completely 180'd from their infinite gains narrative and started spruiking how much harder it will be to pay back a mortgage and investing is going to get a lot harder.

Worst part is they have zero liability and the gullible people who bought into it are the quiet victims of all of this

Homes are the best way to build big wealth no bank is gonna give you 600k to invest in the stock market.

Also a good way to lock yourself into a debt bomb during a recession ;)

The ones who get the press are the 40% that make money on their investment property

The other quiet 60% lose money, have sleepless nights and domestics over their poor financial decision.

It's not the only way to produce wealth. Banks do lend money to invest in the markets, they're called margin loans.

Home are not the best way - if they were, the 1%'ers would be largely mum and dad real estate investors. They're not.

It's simply an easy narrative spun and maintained by successive governments to drive a population and economic agenda.

It's called margin lending for shares, you put down 10%-20% and they lend the balance. The same as home lending, with the exception the ML loan is marked to market each day and can require a top-up

ummm yes they will, I have a margin loan capacity larger than that already.

the gullible people who bought into it are the quiet victims of all of this

They made a choice for themselves, they are not victims.

Completely valid point

But they'll stop at nothing to make themselves out as victims though.

The retirees who 'invested their life savings only to watch it halve in value'

featuring 'My financial advisor said it was a failsafe strategy.

to

'two 21 year olds forever home halves in value, bank of mum and dad have to step in to stop it from being foreclosed on'

With a special appearance from 'But we've had 40 years of solid growth, property only ever goes up!'

No doubt, however there are no excuses, and final blame lays with the people taking on this debt. The lack of personal responsibility is astounding these days.

@brendanm: I mean, sure, but the problem is housing has not been affordable for the majority of young Australians, regardless of whether they are taking on debt or renting.

@skidexa: I get that

And yes this is half the problem

But its also people falling into the propaganda fomo trap and end up with a $1 million 1 bed apartment with nowhere to go that they only really have themselves to blameWhen the median income and median mortgage are so far apart something has to give

I'm fixed for the next 12 months so currently not worried, also I am only paying about $100 a month in interest so double or even triple that won't change my life in a major way.

Good. They shouldn't have been this low for so long. The RBA's persistent mindfulness of household debt is doing nothing but contributing to said debt.

We need a hard reset. They should have moved in line with the Canadians and Kiwis.

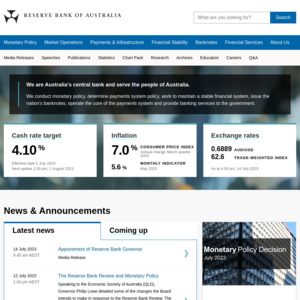

The Reserve Bank has increased interest rates for the first time in more than 11 years, with a 25-basis-point hike taking the cash rate target to 0.35 per cent.

All this fuss over +0.25%? 😆

The title should've been "The-cash-will-never-raise-in-any-meaningful-way."

This is an excellent opportunity to buy more crypto.

I'm DCA #Bitcoin almost every day and is waiting for a capitulation 🕯️ down to <$35,000 to grab more orders.

Btw 🙇 for mentioning 😭pto. It allowed me the opportunity to reply.

Oh, I don't follow the analytics, I just know every single event to a coiner is 'an excellent opportunity to buy more crypto'.

yw fam

Most of the RBA announcements this year and next will be raising the rates. It's only 0.25% now but it'll probably be close to 4% at the end of the year

I don't trust the feds to do what they say they'll do.

They're playing 🐥 with investors.

They didn't say it - they said it wouldn't rise until 2024 lol, I've been telling people since mid-late 2021 that it'll start happening this year.

They printed like mad to suck as many as they could into the black hole before letting it implode. COVID response "monetary policy" and now war is the perfect excuse for a system that was destined to fail anyway. Food shortages, price controls incoming. CBDC's incoming. Don't be surprised to see increased response from UN/WHO types to "save the day" - just with some pretty serious caveats.

Spicy few years ahead.

This was a pretty big signal last year too:

https://www.zerohedge.com/markets/australias-2y-bond-just-bl…

Economics is nothing more than a fortune teller with a degree, and economics as a discipline is no better than scientology, all based on made up crap that doesn't work in reality.

Remember this in one year everyone, all these so called knowledgeable people saying a rate rise is necessary to curb inflation. In one year time after another few rate rises, everything will still be expensive, inflation will not have decreased, unemployment will go up and the amount of people on welfare will too.

Rate rises would be fair enough if it were to curb huge credit overspend, but this inflation is due to a small man wanting to bring back a failed country from the dead.

"Rate rises would be fair enough if it were to curb huge credit overspend, but this inflation is due to a small man wanting to bring back a failed country from the dead."

So your take is we should only use interest rates to attack inflation if we fundamentally agree with the cause behind the inflation and it's a Aussie-based one? The fact it's a Russian supply chain driving our prices up means we can basically ignore it?

Yes, the inflation rate exploded within the space of a week or 2. Floods and covid upped prices slightly or lowered in some instances under covid. But fuel prices went through the roof thanks to Putin, everything else went up and we wear the burden through inflation. The RBA simply used this as an excuse to finally raise rates when the war could end tomorrow and fuel supply recommence thereafter.

I’m no Scomo fan but Russia handed him and the world a turd sandwich as far as increase cost of living goes.

Well, the inflation rate was measured over the period January - March. Anything you're thinking of in April hasn't even been tracked yet, for instance, so it'll probably get worse on existing data alone (not better), if the war ended instantly.

And a rate change, any rate change, is going to take months to take effect on the economy (people with mortgages aren't adjusting their cost of living and discretionary spending overnight) - even if the war ended tomorrow we'd still have probably half a year of knock on inflation effects, surely.

@Crow K: Maybe I am just giving people too much credit thinking they have adjusted accordingly themselves already. Maybe they are still buying those Jimmy cans and Winnie blues and still bleating about cost of living.

Regardless the whole “go out and support restaurants and buy lots of stuff” rhetoric will surely subside.

@Richmond Tigers: Well, exactly. It's only a few months in to higher rates and you're noticing the bank balance is emptying faster that you finally wonder if it's time to cut the Netflix. It's a measure to force people to spend less because they literally have no more cash left, after all..

But fuel prices went through the roof thanks to Putin,

That's incorrect.

The price of oil per barrel moved up long before the war.

The price of oil went hockey stick when Biden put sanctions on Russia.

I have a chart here somewhere but can't find it right now.

Biden put sanctions on Russia.

I've got to know, why do you think Biden put sanctions on Russia?

@apsilon: The price of oil per barrel would've been in a trading range if Biden didn't do what he did.

The price went hockey stick was a direct result of Biden's bad foreign policy.

@Crow K: The oil chart is next to the #bitcoin chart.

Oil is doing rather well bouncing around $103. It breaking up to $147 in the next few months would be awesome.

@rektrading: OK I'll ignore facts and reality and bite…what's in your view, the "bad foreign policy" that directly influenced the oil price ?

@rektrading: That wasn’t a US policy, that was a joint move by the governments of the countries whose central banks “own” SWIFT and it certainly wasn’t the driving factor behind oil price movement.

Even if it was, the alternative is what ? Capitulate even further to an aggressive regime that has invaded a foreign country, raped pillaged and murdered ?

Or all our war between NATO and Russia.Neither option is particularly palatable and either would have been a “bad” foreign policy move.

Or all our war between NATO and Russia.

🇦🇺 isn't in NATO.

They would do well not to get dragged into another war following the puppet master.

Remember that 🇷🇺 unlike 🇮🇶 have WMD.

the inflation rate exploded within the space of a week or 2.

Just because you only noticed or started paying attention during that week or 2, doesn't mean it didn't get a huge run up/head start before then.

what a simplistic and incorrect view. FYI, Russia/Ukraine is just the icing on the cake, Inflation was rapidly climbing even without the conflict due to monetary policy throughout pandemic, the conflict has only moved the rise forward a couple of months at most. kerbing inflation doesn't bring prices down, it STOPS them growing at insane rates, if you want to see what happens if you don't kerb stomp inflation go look at how Zimbabwe went

Up until April inflation was still within target ranges and lower than other developed countries. Then in the space of a month it goes up by 3 points. Simplistic or not it seems to correlate very well.

No it wasn't. It had blow outs last year and was at the very top of the range. Rates were going up with or without war. Basically last year predictions changed from 2024 for rate rises to August this year. Russia brought that forward 3 months

Awesome news.

Inflation is not tipped to be under 3% until 2024

Consequently, the market is forecasting central cash rates to hit at least 1.5% by end of 2022 & possibly 2%.

Ceiling is forecast to be 2.5% to 3.5% by 2024.

Therefore retail bank lending rates to hit ~ 4.5% to 5.5% by 2024.

Those on $1M+ loans to be paying over $1,000/month more

RBA internal modelling forecasts house prices to fall 30% with a 1% interest rate rise. They already put out a media statement last month that Australians should expect average house prices to fall at least 15%

The great thing about cash rate hikes is the Australian national debt will be so much more expensive to pay off.

Gotta love the work of the Better Economic Managers™ with all those jobkeeper handouts to profitable companies,

House prices may fall but are people willing to sell knowing what house prices could be? And will those who can’t get credit now to buy houses be any more likely to afford a cheaper house at a higher interest rate? The chillout boy thing really stopping affordable housing is terrible urban planning and reliance on CBD’s.

The only real winners are people who sold now, downsize and put money into savings, they get it all!

House prices will fall because of two main reasons:

1) Maximum borrowing capacity falls resulting in less demand for houses at certain prices/levels

2) Forced mortgagee sales as people hit 90+ days missed payments (I was at 2 such sales just 3 weeks ago - the market is overheated)

3) Investors sell as they avoid higher repayments

4) People always buy & sell houses

Problem with those figures is Australia isn't one big market, it is several small markets. What happens to me in semi regional SA is afar different than my friends in Sydney.

True. I expect Sydney & Melbourne to be hit hardest.

What is a little unknown is whether the 'work from home' phenomena is allowed to continue by managers/bosses. If not, outer suburban & semi-regional prices will fall at similar rates (they will still fall regardless, the question is the rate)

I don’t hold a hose.

All locked in at 1.84% - 2.29% for up to 5 years starting late last year. Plenty of time to adjust.

this is what happens when you print money to infinity during the pandemic, propping up businesses that came out richer than had they not received jobkeeper

calling it, global recession within 2 years

I'm thinking this time next year we'll be back in one.

After being in one before the covid money printer went brrrrrr we never really got out of it, merely prolonged the inevitable by throwing fake money at the problem.

"After being in one before the covid money printer went brrrrrr"

Bingo! People forget that the Better Economic Managers™ took us into a recession without the pandemic

Will be 8% plus soon enough

Let's just throw around random numbers for attention.

We’ll see

The cash rate is still relatively low in absolute terms, even when they jack it up a few more times. Only the idiot serial whingers would not have budgeted for more "sane" interest rates for such a large loan as a house.

Also much like taking everything in relative value, the market has gone up at such a ridiculous rate the past few years that even a "crash" now most people would still probably have a big bump in capital gains value if they are in those hot suburbs. Alan Kohler pointed out something similar too yesterday. The "drop" in Sydney's figure was a pittance to the gains made so far.

All in all, it's about friggin' time. This whole ticking time bomb of political parties with this ponzi scheme of a property market being obsessed with policies all designed to keep the money being pumped into the prices. It's not just low wages part of their "economic design" but also "feel rich on a paper value of a home" too. Reap what you sow …

Maybe my savings will finally do something more lol

Many budgeted. But on a $500,000 loan, 2% increase is circa $6k pa. Still tough to stomach no matter how well it’s been budgeted.

Onlyfans are hiring.

Why do you care about interest rates anyway, aren’t you a multi millionaire bitcoin trader?

@Vote for Pedro: The cash rate going up will have a broad effect across all hard assets.

The SPX is a bloodbath because the feds are playing with the number of hikes this year.

Weak 🙌 are losing their 🧠 and 😭 themselves to 😴 fearing a +0.25% or a +0.50 hike this month.

@rektrading: No weak hands in the property market because auction clearance rates are fairly low. Can't sell where no one is buying.

@plmko: I don't know about Australia but MNC real estate tycoons and hedge funds in the US have been buying up 1000s of rental properties. They're buying whole streets and paying with cash where they have to.

The people that are selling now will regret selling to real estate hodlers. They'll end up paying more later or rent for the rest of their lives.

Of course. I hate paying more than it is.

Those who are loudest whingers to the pollies (or vice versa for vote grabbing) I dont imagine will be the ones who have built in some buffers.I mean that $6k p.a. is a drop in the ocean to the tens if not 100k a household was forced to pay extra thanks to the long term policies obsessed with driving up house prices.

I fixed at 1.75% and have another two years to go on that, so I don't mind the rate rise.

It's curious that panic merchants in the media are talking up the doom and gloom over…. 0.25%. Come on people, it's nothing. If that rise causes problems for you, then you have borrowed far too much.

It's more the approach to taking on more debt for the first time in 12 years has reversed.

Before it was take on as much as you'd like

Now it's going to be how little can i take out so i won't be burnt in a years time.This mentality will limit the disposable income and turn consumer spending on its head.

Umm, 0.25% is just the first increase. The RBA said expect 2.5%

2.5% is no problem at all. Think back to the GFC and the 3% emergency rate we had.

The RBA targets an inflation rate of between 2 and 3%. It was always inevitable that we would have interest rate rises. There have been countless media articles over the past ~9 months that rates were on their way up, so people had plenty of warning.

The only truly foolish statement in all of this was Lowe's claim that 0.1% would remain until 2024.

2.5% (lower bound - could be up to 3.5%) is a huge hit to repayments & borrowing capacity.

RBA warned people last month for a house price fall of 15%, adjusted for inflation

Christopher Joye (Coolabah Capital), the most accurate of economic forecasters on house prices for the last 15 odd years, predicted house prices would fall 15% to 25% with only a 1% central rate rise. Its forecast to rise 2.5% to 3.5%.

Oh no, 2.5%, how would I possibly cope. 😂

Yep, I get to clean up

@brendanm: Staked your Palmer & his five daughters election advertisement in the front yard yet?

FREEEEEEDOOOMMMMMMMMMMM!!!!!

This 0.25% signals the start of a tightening cycle, this isn’t a once off move.

Shouldn’t be an issue. If you haven’t given yourself breathing room of interest rates going back to 7% or so, then you’ve set yourself up to fail.

The banks were pushing for the removal of the limits during covid so they could up their lending limits.

I'm not sure how far they got with it.

The banks limits, and peoples personal limits, are two different things. People shouldn't need their hands held to think about what they could afford if rates go up.

I don't think people will crumble and sell as a response to being forced to put another $60 into their mortgage each month. But for sure people are going to think twice about buying considering the forecast of consecutive rate rises. It's a slow burn from here on out, and if supply/demand does its thing we might see property drop to match its actual value.