A rise after 11 years. Interesting times. How will OzBargainers be affected by this? Keen to hear your thoughts.

RBA Raises Interest Rates by 25 Basis Points

Related Stores

Comments

If you live in Aus, 4wd is probably considered 'mandatory' by many, especially urban soccermums/dads.

Why would imported things cost less here unless the $ booms against other currencies. Except, more often than not, those companies will take the profit rather than drop prices

Probably talking used car market. Supply vs demand. People will run more efficient vehicles if money is tight. So might be a period where people sell the land cruiser and get an x trail.

Maybe. But used is usually pegged to new

Sorry meant second hand market.

now maybe I can get a Landcruiser in 2 months instead of 12 months wait

In February this year, 9 out of 10 top selling vehicles in Australia were utes and SUVs. Only one passenger vehicle in the top 10 (Hyundai i30).

The market has turned, and not necessarily for the better. People pop out one baby and then think they need a 2000kg vehicle to protect it because everyone else has an SUV.

I am getting a 2.5T Vehicle so I can tow 3T caravan and travel around Australia with no end date, camp on the beach, eat fresh fish with catch of the day

where I like I stay a bit more, where I don't like I move on.

Cool story bro.

2.5T Vehicle so I can tow 3T caravan

Have you actually tried this yourself? Don't push the limits of the tow car, and don't tow something heavier than the vehicle.

Rigid trucks aren't generally allowed to, and I can't imagine why someone would think it's a good idea to do regularly with a light vehicle

@BobLim: Ya, I am an outdoor person done lot of 4WD, hiking, camping and towing

https://www.carsguide.com.au/toyota/landcruiser/towing-capac…

@MrMarket: Aha not what I thought you meant - LC300 would be "over 3T" in my view, and hopefully your caravan doesn't need to be touching that upper limit?

Good luck with the new drivetrain if that's what you're getting

I think so. Many people use the equity in the homes like piggy banks and top up the mortgages to buy cars. If rates go up and house prices come down it might affect people desire or ability to raid their equity

Not happy

Why are eneloops 0.25% more expensive?

Where am I supposed to get that extra $15 per week to pay my mortgage from???

Sell your Corgi.

I bought a house during the pandemic because of FOMO. AMA!

How much did you pay?

Just abit over 1m.

That’s not too bad for Syd.

Did you factor in the rate rise/price drop and up to what interest rate can you comfortably still cover? Went to quite alot of auctions to gauge market sentiment and wondered if winning bidders were prepared for the inevitable rate hike/price pull back.

Yes up until around 9% interest rate with our current income. But if it's true thatt interest rate hike will cut down cost of living (grocery, food etc..) then we will be able to save even more money to cover the mortgage rate hike.

I was expecting it and fixed. When I first got my loan I was paying 4.19% anyway so I'm not going to worry for unless RBA overshoot 3.5% expected ceiling for 2024.

0.25% rise is a big deal and this is blamed upon ScoMo and the Liberals - stop the monetary stimulus that has been injected into the community in pursuit of winning an election.

Better Economic Managers™

The RBA dude said on record that rates are not going rise until 2023 or even 2024 so he misled everyone!!!

Lowe made the statement in 2020 and it was a really foolish thing to say. Economists have trouble predicting events six months out, so to claim he could foresee 36 months forward was utterly stupid.

The writing was on the wall from mid 2021 that rates were going to rise, and rise soon. Everyone who could read knew that.

In life, most of us are experts at subjects that have very little matter or meaning to our life.

He PREDICTED and he was called out as being extremely optimistic back in 2020 when he said it and then called outright wrong in 2021 when it became obvious that it had to hit before end of 2022. As it is this rise should have happened months ago.

a big banker/elite misleading someone..? the nerve..

And now he calls 2.5% which would mean 5% interest rates…

That's after he said no rate rises until 23/24

Might as well say nothing coz what he says means nothing

Personally I believe house prices will go down in line with interest rate rises.

I bought a house in 2015 for 1m in inner Melbourne and it sold for 1.35 in late 2021. No structural changes, just paid 10k for staging and a lick of paint.

The interest only rate when I purchased was about 4% (800k loan) and with the current interest rate at 2% (assuming 1.08m loan), the repayments are almost identical at around 3600 a month.

I strongly agree with previous comments regarding the amount banks will lend will decrease as interest rates rise, hence driving down the market.

What did you do after selling in 2021? Buy elsewhere in Melbourne, hold your cash, invest in other assets, move to another state (like a lot of Melburnians last year)?

I am fortunate enough that my partner has a property similar to what I sold so all the money is sitting in my partners offset.

I am working on a business which I will need to fund heavily in the near future hence my property sale.

So you made 5% annual return… Pretty in line with the average over the last forever. I don't understand your point.

There's a point in there

They bought at 4% for 800k

Interest rates are now 2%. The same repayments could fund 1.08 million loan.Except the house is now worth 1.35 million.

So someone buying today is already behind financially, even at the historically low interest rates.

Hopefully $AUD will be on an upward trajectory now. With covid restrictions lifting I have a lot of travelling to catch up on and a higher AUD is helpful.

I imagine people will scrounge and save more to pay their mortgages rather than be forced in to an unwanted sale, so business will be affected more than property.

when can we expect this to flow on to banks? I'm actually looking forward to it as I've fixed half of my home loan, got 80% of the other half in an offset so it will barely effect me, and will actually mean it might make sense to once again put money into savings once the debts are paid off.

idk why people would take out massive loans they can't afford to pay off in as little time as possible, lining big bhanka's pockets and fearing these sort of events - which were forecasted well over a year ago

idk why people would take out massive loans they can't afford to pay off in as little time as possible

Greed. Buy much as you can afford say $1m (even lie about it) rather than $800k because if the market goes up 10% then you've got $100k vs $80k. Or you just want to be the person who paid the most at the BBQ because it implies you are richer than everyone else.

This does not benefit the Australian needy.

Democracy has failed, equality must be the way

The cash rate is adjusted independently of democracy.

I thought RBA board meets and votes?

The central bank makes an internal decision.

A democracy is a system where all citizens are allowed to vote for representatives in government.

@rektrading: You vote for who is in government and they appoint people to RBA board to act for the people.

You want a vote for everything? Do you have a household referendum on whether you can go to the toilet?

@netjock: Central bank board members are NOT voted representatives by citizens.

They're public employees appointed by the government.

Central bank board members are NOT voted representatives by citizens

We also know how well it goes even when citizens do get to vote for their MPs.

Let the story of the Cooperative Bank UK be a lesson to us all about citizen election of people onto management committees of financial institutions

Read above to see why you don't elect priests, plumbers, electricians, teachers and nurses onto boards that run a bank.

You actually confuse the idea of a "working" democracy.

Can you imagine if the democracy voted on interest ratest? We'd be (profanity).

This how yield (interest rates) are set in DeFi. The entities with the most tokens (money) decide the APR.

Democracy has failed, equality must be the way

You don't want equality, you want equity.

Democracy is fine.

Many people are financially inept.

Any thoughts on the impact on online savings accounts? I imagine ubank and co will be much more generous than the big 4.

personally I'd expect nothing until we have a few more hikes but then it will become competitive from second tier down

Explain me like 5yr old - how does inflation force rate hike? What's connection between inflation (ie price increase of my daily grocery , petrol) and RBA repo rate ?

Why do interest rates change?

Interest rates determine the cost of borrowing or lending money and are used to influence the rate of inflation and economic growth. But why do interest rates rise and fall, and how can they affect you?

Who controls interest rates?

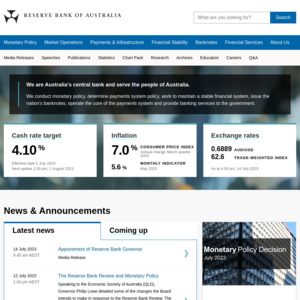

The Reserve Bank of Australia (RBA) sets the official cash rate, the interest rate that it charges on overnight loans to commercial banks.

This cash rate affects all of us because it has a knock on effect on financial products, such as savings accounts, term deposits, mortgages and personal loans. It also impacts the cost of funding for the banks.

The RBA's objective is to promote a stable currency, full employment and economic prosperity, ensuring that price growth, or inflation, remains relatively low and stable.

Its 'monetary policy' involves either raising the cash rate to try and slow the economy down, or lowering it to promote economic growth.

The RBA's decisions are based on indicators including employment, inflation, gross domestic product, consumer and business confidence and the housing market.

If the economy is growing too fast it can lead to high inflation, while weak economic growth can lead to unemployment, reduced incomes and lower living standards.

Global outlook

The RBA also looks at important international factors that will drive the performance of the Australian economy, in particular demand for and the price of Australia’s natural resources.

If Australia’s trading partners are growing strongly and demand and prices of raw materials are rising, this can lead to strong economic growth in Australia and push interest rates higher.

If commodity prices and demand for our natural resources fall, this could point to slower growth in the future and lower interest rates may be necessary.

When do interest rates change?

The RBA board meets 11 times a year on the first Tuesday of each month, except in January. When they meet, they will raise the official cash rate, reduce it, or keep it the same.

nice copy n paste

Oh look, let me make a comment so i can state the obvious

Don't worry, for the majority of normal people (myself included) there seems to be no sense to any of this.

At the end of the day interest rates on credit you owe go up, the interest accrued on any savings goes up and borrowing cash will become harder.

In terms of how it will effect us plebs, everyday items will not come down in price for quite a while. Chuck in Ukraine and global supply chains being effed in the A, it probably more pain for your everyday people living week to week.

I'll give it a go. Inflation is often driven by more people trying to buy "the things" than the makers of "the things" can supply, this allows the makers to charge more as if you only have 100 to sell you might as well give them to the 100 people willing to pay the most. If you increase interest rates you take money away from the people, meaning less will want to buy "the things" and the makers of "the things" will have less power to charge more. That is the basic supply/demand curve.

Now if people start expecting inflation of X% per year it starts getting complicated and a sort of feedback loop occurs where they expect wage increases of X% which then means makers of "the things" have to pay more wages and push prices up just to keep their income steady which causes inflation to rise which means people want more wages…. We are nowhere near this but it is called Hyperinflation, Turkey is prettymuch there at the moment.

US forecasting rates to rise to 5-6% and people are already wetting the bed over 0.25% here

https://www.marketwatch.com/story/how-high-can-the-fed-hike-…

RIP to anyone who recently bought the top

No one should stress if they bought the top but if they're fully leveraged with any lifestyle change that will adversely impact their earnings they should!

People deceived themselves if they thought 0.1% was sustainable. Free money does not exist.

0.25. jeez, let's talk when we hit 2%

2% is piss, lets talk when we hit 18% (late 80s australia)

18% is a piss, let's talk when we hit 100% (late 25 BCs)

lets talk when we hit 2000% (loan sharks)

Bikies

18%, but on much smaller loans (in all circumstances, including house price to income ratio).

(profanity) yeh ill take 18% on a 40k home in Sydney over 4% on 1.4 mil any day..unless salaries in the 80s were $2500 a year.

While homeowners will, for the most part, plod-on and pay a bit more each month to keep their roof over their head, it’s a different matter for property investors. If you’ve invested in a property, and it’s loosing money every year (neg gearing), and it’s going down in value (cap loss), and a realistic view is that this isn’t going to change anytime soon, you get out.

First of many. Things won’t get better until they hit at least 6% imho.

No issue. Jack it up to 5% for all I care.

We're prepared for this and so should most others. You'd be a fool to think HISTORICAL low rates are meant to last forever.

Unfortunately everyone has different circumstances. Life happens, especially when we are talking about roof over head scenario.

Yep and in turn, they need to adapt and account for their mistakes.

It's only beginning! I am convinced we will have 4% rates or more by 2023. Interesting times ahead of us.

Once immigration kicks in later this year, it will stop expected wage growth and pressure the rental market even more.

High interest rates combined with expensive rents and inflation will result in less discretionary spending, and therefore, jobs loss for bussiness due to less customers.

All that will result in recession in following years.

im tipping a depression

I am just very bearish when it comes to the economy. :-) For sake of us all, I hope I am wrong, but all mentioned signals are there.

I've always felt that way about the Australian economy which from my perspective is essentially made up of:

1.) digging holes in the ground and selling rocks

2.) building houses

3.) selling garbage education to immigrants

"High interest rates" - how is anything under 5% "high"?

How is 17% interest rate repayments on a $100,000 home in 1990 'doing it tough'?

two wrongs don't make a right

@MrBillions: Its reference to people who downplay current low interest rates, as they exclude the issue of current property prices

Mortgage repayments as a percentage of income are far higher today than in 1990

@Boogerman: Not saying you're wrong but the other side of the coin is the change in income. Had someone bring up a similar argument on Reddit recently so I looked it up. Average home loan repayments in 1990 accounted for just over 40% of income and now is just under 30% of income so yes property prices were lower but so were wages yet the amount of income spent on repayments was higher.

@apsilon: You're also not taking into consideration other relevant factors. In the 1990s, wages were rising very rapidly, enabling people to pay off their mortgages (which become increasingly smaller in comparison) faster. We are not really looking at that kind of rise in wages in the near future. Also, just say you want to pay off your mortgage faster nowadays. By paying it off faster, you avoid paying a lot of interest. But you still have to pay off the principal. And the principal is much much higher as a proportion of income nowadays. So we have fewer options than in the 1990s.

@apsilon: @apilson I'd suggest this is just a neat factoid that can only be generated by making poor selections around data to create a narrative (i.e. found one blog written by a property spruiker which compares average loan, average salary & the cash rate of Feb 1990 with the cash rate in 2018). I presume this blog is the basis for your assertion (https://www.ratecity.com.au/home-loans/mortgage-news/28-year…)

If we don't bother with the cherry picking & look at expenditure trends over time:

- In 1990, median dwelling price to income ratio was 4:1 & now it's around 7. [1]

- In 1989 households spend 12.8% of their average weekly expenditure on housing & in 2010 this was 18%, 2015/16 it was 19.6%. [2]

- In 1994, 80.3% of households spent less than 25% of their income on housing. In 2017, this had fallen to 75.3%. Additional brackets available below [3]

[1] https://www.aph.gov.au/about_parliament/parliamentary_depart…

[2] https://www.abs.gov.au/statistics/economy/finance/household-…

[3] https://www.aihw.gov.au/reports/australias-welfare/housing-a…

$100k was pretty high back then. My parents sold a house in a country town for $18k in 1989.

Houses in that same town now start from $1 million (or $700k for an asbestos-lover's renovator's delight ).

Pretty sure wages haven't gone up an equivalent amount.

It is when your wage was $16k

It's all relative.

Well, yes, you are right, but it is relative. People bought over 1 million houses in the last two years for record-high prices with the lowest interest rates we ever had. I don't think many of them priced 4% RBA rates in their decision.

Going from a 2% to 5% interest rate (bank rates) on a 500 thousand mortgage is an extra $836 per month that people cannot spend elsewhere. That's a lot of money that will not be spent in our economy.

If rents rise again I’m leaving nsw forever

I may have missed it, but has anyone discussed the RBA rate rise and the resultant impacts on cash investment interest rates, pension deeming rate, etc.?

I'm interested to see what the banks do. I mean they rarely passed on the full rate cuts so it will be interesting if they pass on the full rate increases.

I'll be interested to see if discretionary things like sports cars and 4wds start dropping in price as interest rates rise and people want more cash.