A rise after 11 years. Interesting times. How will OzBargainers be affected by this? Keen to hear your thoughts.

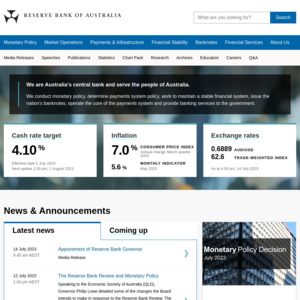

RBA Raises Interest Rates by 25 Basis Points

Related Stores

Comments

"Human society has been moving towards equality for hundreds of years. It will continue to do so." Strongly disagree. Economic inequality is increasing. 70% of newly created wealth goes to the top 1%.

The only way to create economic equality is to abolish private property, the basis of democracy and of capitalism. The existence of private property results in a small number of ultra rich, a modest number of middle class, and a majority of lower class (who are treated like garbage by the 2 classes above them, since the middle/upper classes control teh media, politics, academia and entertainment industries).

@RefusdClassification: Yes, we have created a society with a small ratio of super wealthy people. But the poorer classes are still better off than they were 50 or 100 years ago. Plus they have way more rights now.

Labor is proposing a policy that could increase wages in low paying, female-dominated jobs. Conservative governments will always attempt to chip away at the progress we've made in achieving equality, such as when they take an axe to progressive taxation or when they implement policies deliberately intended to increase house prices. But, in the long-term we will continue to see new policies and laws that tend to increase equality.

If you look back over history, you can see a general upward trend for equality.

The only way to create economic equality is to abolish private property, the basis of democracy and of capitalism.

Private property is a human right. To do away with private property is to take away human rights.

@RefusdClassification: It sounds more to me that you are describing equity rather than equality. Economic equity is only possible if all participants are equally skilled, equally put in the effort, and are equally charitable. This is not the case for our world.

The lower class are better off than they were 50+ years ago.

Makes some sense, what doesn’t make sense is: When interest rates went down more people could afford to buy homes. So why when interest rates go up, people still won’t be able to afford homes if they couldn’t before?

Because they had already saved up deposits in higher-interest times

Thanks Phil Lowe

That's not true at all. You're only comparing the outcome of people who don't already own a house (or substitute it for any other asset) with each other and not comparing them with the people who already own a house. You're also only looking at the opportunity cost denominated in terms of money and ignoring what it looks like when it's denominated in terms of hours of labour. Lower interest rate is a wealth transfer from the have nots to the haves. Asset price increase in a rate cut environment outstrips wage increases. The working class is clearly worse off when the central banks tries to "stimulate wages growth" by easing. Sure they're better off in nominal terms, but in relative terms, they're worse off.

Denominate prices in terms of per unit of labour cost and it comes clear.

I also majored in Economics in university and spent most of my adult life dealing in short term interest rates. Whatever happened to central banks serving the function of smoothing out business cycles? All they've done in the last decade and a half is exaggerate business cycles through failed monetary policies. Economists harp on about free markets, yet the only blatantly unfree market in the modern world are in money markets where central banks fixes the price and the supply of money, distorting asset prices from what they otherwise would be trading at if money markets were a free market.

So if, inflationary pressures are primarily overseas based around supply. How can interest rate changes impact on demand and local prices without a disproportionate adverse effect on local economy. Essentially, if it's not monetary forces causing inflation why would monetary forces be an appropriate solution.

So the loser is people who have bought houses at high prices then? They can't sell for lost, and will have to pay high mortgage for less than ticket price?

All they need to do is hodl.

The market is guaranteed to pick up again in the long term.

This is financial advice and you can screenshot it.

Isn't it better to buy something today with debt denominated in highly valued dollars and then pay it back with devalued future dollars?

Therefore it is always better to buy when it is more likely for interest rates to go down so that your debt can be inflated away.

Buy hard assets with debt (fiat 💵).

The asset value goes up while the debt gets devalued.

Sell the asset and repay the debt with profit.

Or

Keep the asset that has now +100% and take on more debt to buy more assets.

Both methods work with proper risk management.

scomo prolly release a new promise, interest rate hike bonus, get 250 bucks to help with interest rate hikes

once off, marginal seat areas only

What’s new.. buying off voters…

But he told us the economy is strong thanks to superior LNP management!

I thought it was strong because of curry or something?

Salmonella breeds strength

Its not a competition! :)

RBA is a separate entity.

RBA is much of a separate entity as the ABC is

One party has already promised to keep rates low, because parliament can definitely do that, sarcasm of course.

https://theconversation.com/clive-palmers-promise-to-cap-mor…

You have to be brain dead to believe that crap. But in saying that their other billboards around here literally just say "FREEDOM FREEDOM FREEDOM" so brain dead is probably being generous. Unless they are targeting USA expats?

Unless they are targeting USA expats?

There's another political party that seems to be an amalgamation of both LNP and Democrats - aptly called Liberal Democrats.

I reckon that's the one targeting US expats.

Will they fix the tax treaty? Our ATO and banks send personal information on US citizens (who may also be AU citizens) to the IRS regularly. Its actually a big problem..

@axloz: Why would the tax treaty with the USA need to be 'fixed'? It appears to be doing what it was intended to do.

Perhaps you could outline what the big problem is?

@GG57: It forces Australian financial institutions and government organisations to hand over personal information on Australian citizens to a foreign government, without seeking specific consent to do so.

Its not just AU that suffers from this though. There's legal action happening in the UK, citing breaches of privacy laws.

I don't like the idea that personal information is sent to a foreign agency by anyone other than me, and/or without explicit consent.

The knock-on affect is that for anyone with US residency status (not me thankfully!), buying property becomes quite risky due to currency fluctuations.

It forces Australian financial institutions and government organisations to hand over personal information on Australian citizen

Don't you need to also be a USA citizen to be affected by this?

The banks don't have to do it, but they choose to do so as they want to keep their USA operations and stock exchange listings etc.

You may not like the idea, but I'm ok with people (and corporations) being responsible for their taxation commitments. Like most things, it is only those that want to hide something that worry about it.

@GG57: Yep, its for US citizens. Our banks just bend over a little too far for our american friends sometimes..

I don't disagree with people/corporations being responsible tax citizens at all, but the tax treaty doesn't seem to be very fair to those US citizens living abroad. It opens up possibilities to be taxed on things in the US that aren't taxable here in AU (such as your family home), and if you hold a mortgage and there are currency fluctuations the IRS may choose to view it as a 'speculative' = taxable. I'm sure there are good reasons to have these things in place, but the rigour applied does not favour many who are just regular (albeit dual) citizens.

Again, thankfully not me, but I have friends who have to deal with it, and I feel sorry for them.

@axloz: Ok.

Again, and from your further information, I don't see what the problem is. If citizens of USA choose to live overseas from the USA, they are subject to those laws.

I assume that they could renounce their USA citizenship if they wanted to overcome this. Given that USA citizens may be called to military service, some may think this is a good option.

Your friends have choices. I wouldn't feel sorry for them.As an Australian with no other citizenships, I have lived and worked in numerous countries. I've had to comply with both the Australian regulations and those of my 'host' country. That's just how it is.

If passed on in full by banks, the rate rise will add more than $50 a month to repayments on a $500,000 mortgage, and double that on a million-dollar loan.

Not looking good for me & other homeowners here. Defo means less Ozb spending.

8 more consecutive rises predicted, from now til xmas

8 more consecutive rises predicted, from now til xmas

Sensationalism. RBA meets monthly. Inflation stats comes out quarterly.

Whoever predicted it is bound to get it wrong.

not sensationalism at all, barring any other economic shocks it is very high probability, especially as they went light on with the rise. Even the RBA has categorically stated more rises are coming as inflation will continue to grow through 2022. expect at least 1.5% this year for cash rate.

barring any other economic shocks it is very high probability

You know the economy is pretty much in the dumpster. There might be a labor shortage but wages are still not going through the roof. China isn't going to reach their growth targets. Europe is stalled and US is slowing down.

Raising interest rates on inflation driven mostly by supply chain issues cause offshore is probably not wise.

But then I have fixed 80% of my mortgage at 1.84% - 2% out to 2024 / 2026 (last tranche about 40% was fixed late 2021 at 1.84%)

Knowing that fuel inflation is 11% people aren't going to drive 10% less, they are going to drive 10% more as revenge for 2 years of lock downs. Got to love people shooting themselves in the foot.

@netjock: I agree with you there. Looking at the basket that contributed to the higher inflation, not much is outside of price increases impacted by supply chain and in some cases labour shortages. Neither of those things are underlining long term trends. The problem for the RBA is that it's got one instrument to apply and it's used it. Whether it will blunt consumer demand to cap inflation is more wishful than anything…

Whether it will blunt consumer demand to cap inflation is more wishful than anything…

This is the problem. I probably drive 5%-10% less kilometers than before the war. Lucky I drive a hybrid and can survive the 3 week between peak and trough of the fuel cycle quite comfortably.

Not at all.just 6 months ago, RBA stated there won't be any interest rate hikes until 2024. Here we are with hikes 2 yrs in advance. This is a start. You will see 4% variable rate by year end. No joke.

Moreover it's not just about mortgage payments. It reduces your borrowing capacity. Less money…less competition.

@CrypticM: You know the RBA is targeting inflation. Unfortunately not house prices (which is also inflation).

Have a look at the latest inflation figures here

5.1% inflation driven by: higher housing construction costs and fuel prices. Fuel prices we can do nothing about. Housing construction: depends on who you ask, higher cost of timber and other commodities are not driven by us.

BOTH of these are not really people paying over the odds for iceberg lettuce grown here, rather it is a globe problem. Then you might just ask if everyone just stopped building and drive 10% less would that solve the problem?

@netjock: Yes, I know it's about inflation. But I strongly believe this rate hike have more impact on housing than real inflation.

But I strongly believe this rate hike have more impact on housing than real inflation.

Wishful thinking. Probably be people rushing to sell initially due to unable to service or wanting to cash in but in the long term it is better to hold real assets than cash which means property might go up.

Historically, real assets have performed better than other asset classes during spikes in inflation, and they’re uniquely equipped to provide investors with a means to ride out the current inflationary surge. There are several key reasons for that.

Income from real assets is generally linked to inflation. As prices rise, so too does income.

During economic upswings, real assets such as real estate and infrastructure tend to do well as demand increases, rents rise, and utilisation improves.

Over the long term, real asset returns historically beat other sectors during inflationary spikes.

@netjock: And petrol has already got cheaper since the last inflation numbers.

The media has been banging the drum for a rate rise for a while, even though this will do nothing to impact the oil price, which is a big reason for current inflation levels. More for clicks pre-election than any real need to act right now. Genuinely believe the RBA would not have moved this month but for this media pressure.

Inflation = rate rise is the mantra, but when external factors lead to much of the inflation (fuel prices flow on to the cost of everything) its not that simple. Likewise predictions of ten rises etc, even top economists can't accurately predict this stuff let alone media hacks and their clickbait. The same people said the housing market would crash due to covid…

One thing no government here will want to do is allow the housing market to fall too much, basically political suicide in this country. This is why every "solution" to affordability (first home buyer grants etc) does nothing to reduce prices. Our economy literally depends on housing values remaining healthy. Therefore I do not believe the doomsayers in terms of rising rates. We are a lot more sensitive to rate movements now and I expect even small moves to have quite an effect.

It's also driven by the bond market, which has signalled that of the next 14 announcements, 12 will be rises

@MindGrenadius: Bond market driven by what it believes the central banks will do. Just a feedback loop. It isn't like the bond market makes up the rates. Bond markets have been wrong. The German Bund at negative rates. Who rationally would buy that? It is because the ECB made banks buy it, who would have thought.

Australian bond rates at 0.1%? Because the RBA kept on buying it to depress the rates.

@MindGrenadius: Fixed rates driven by similar things and until about 6 months ago you could get 3 years at under 2% (I did exactly that). Economic forecasts are like trying to predict the weather. For the next few days you might be right, after that complete guesswork.

not if but when

slow to pass reductions and not in full

when it's a rise it will be done immediately and in seconds

kinda should be place on ozbargain, the banks have immediately raised interest rates on loans. what a deal

but also $1,251 more cash in your interest account

Got a million dollars worth of debt with rates as close to zero as they will ever be … but people don't have $100 worth of room to move in their monthly budget?

Sounds like a case of economic Darwinism.

If things are that tight you need to reconsider if housing is a good idea to purchase

This is just the beginning…

..of the end.

The end is still a long way off. ;)

Ah, but what of the end of the beginning? That's on the weekend.

Unless you have an electric ute.

Then you don't get one.

Can someone explain to me how this works?

Cost of living has gone up yeah, prices of groceries up etc. But they raise interest rates now?

Doesn't that make it harder for people? I am clearly not educated in this area lol.

I think UNeed2Skool

I am PE teacher damn it. Not an economics teacher.

One thing I will say. I am glad I did not take out a ridiculous mortgage last year. We bought the house based off being able to make repayments even in emergencies. Many of my friends thought that buying 1 million dollar properties in substandard areas were a good thing.

RIP to them

Alright PE teacher

Imagine a bunch of little kids trying to kick the ball. That's bad because too many strikers not enough defenders. So you pour some gravel into the ball to make it harder to kick.

That's what happened today, a bit of gravel went into the ball. Stuff those kids.

@echelon6: Being a physics teacher, can you youtube me how to pour gravel into a ball, id like to see that

Wise move not to over-extend, props to the PE teacher!

I think budgeting to afford repayments on a 7-8% interest rate is a safe way to make a decision on how much debt to take on in today's mortgage market. This yardstick may change by the end of the year though..1M properties in substandard areas can be good though, as long as the area has some potential. Buying property to live in is a long term investment remember!

@axloz: Thanks!

Yeah i thought that too, but imo the area was over developed and no infrastructure in roads made.

Was even on ACA not too long ago with people taking 1hr just to get out in the morning 😂.

We just made sure our first house was something we could afford regardless of the interest rise and like you said was a long term investment!

@axloz: "I think budgeting to afford repayments on a 7-8% interest rate"

absolutely, I based ours on 10% though having witnessed the high teens rates.

our first house cost around 3/4 the max loan amount the banks would lend

.

@Nugs: Yep, budgeting on a 10% rate is solid, well played. I can only imagine how far ahead you would be if you paid that extra in over the past few years, kudos!

The key is the inflation rate, recent official figures put it at 5.1% which is way above the reserve bank's target of 1-2%. The high interest rate is just their tool to reduce the amount of money supply which theoretically will reduce inflation.

given the cost of petrol and food is related to external factors.. seems a bit of a big stick approach

Well when we've had 15 years of successive governments pumping the economy full of "free" money … and refusing to rein in spending … the RBA has little choice.

RBA is responsible for monetary policy.

One objective of monetary policy is 2-3% inflation target.

Inflation was 5.1% which is above this target band.

Therefore RBA increases cash rate (which influences interest rates) to curb inflation - borrowing capacity decreases, less discretionary spending, people put more money into the bank (reducing money supply).

If you have less demand for goods and services, holding all else equal, that means prices should decrease (look up a supply and demand graph, a decrease in demand is a shift of the entire demand curve to the left meaning lower prices) - I.e. less inflationary pressures.

RBA knows inflation is going to explode after they doubled the money supply since covid started. In other words, everything is going to roughly double, including salary since covid. Is your salary still the same? Boy, do I have bad news for you…

If the AEU get their act together and actually agree on the new eba then maybe I will get a wage increase.

They've been hamstrung by the current government which has effectively eroded all power by the unions.

As much as i hate trade unions they exist for a reason.I've been lucky enough to be in an industry backed by unions and our wages are happily bubbling along.

Heaven forbid if you're stuck in private with zero negotiation power.

@Drakesy: Unions are hamstrung because they're redundant entities focused only on building the wealth within their own ranks (especially show by the fact delegates are paid more than their highest paid represented). Fair work have pushed out the need for unions.

Pay increases need to be universally pushed for. Unions are exploitive of large companies, their only benefit to the workforce as a whole is that large corporations are providing better benefits and treating their workers better to keep the union away.

If as an engineer, there was a union for me to join I probably would just for the pay (although I receive great benefits already and a union would probably just cause unnecessary conflict, might not be worth). The union sites I have worked at have a massive pay distribution disparity. Unskilled, uneducated operators end out paid much higher than the engineers they palm their problems and responsibilities off to. And when they mess up we have to take responsibility for why they were able to do something so stupid, literally have to idiot proof union sites to the detriment of production. But because the union workers are continually paid more and well above their market value, the people who take the responsibility, fix their problems and have to answer all the questions lose out because there's no more money left to allocate.

@Juice-Wa: As an engineer myself you shouldn't complain when an operator is paid more than you. Maybe take a step back and think are you getting paid a fair wage?

I did, moved to another company which is under a union agreement and now happily earn 40% more for the same workload.It rewards those inclined to change and tbh is the only way of ensuring wage growth while private erodes your wage and boosts profits

@Drakesy: Fortunately for you, you have found the hen's teeth. This is the first time I've ever heard of an engineer on an EBA. Union despises engineers because we're seen as siding more with management. Rather than viewing us as sitting between management and operations, they're combative because we know how ridiculous the requests of the union are. To be paid as much union operators would be extremely generous, pushing over and above what is fair. But what they are on is more than double what they're really worth in the workforce. I now work for a large mining organisation which have thankfully pushed the union out and as a result everyone receives the exact same yearly pay increase. Which is more than I can say for my friends working for union sites in the same town, EBA salaries increase, engineer salaries stagnate because there's no money left. I don't have experience with other unions but for a fact the CFMEU and the MUA are some of the laziest, most selfish and corrupt organisations in Australia.

@Drakesy: I'm curious as to why you hate unions when you admit they are responsible for the benefits you enjoy?

@Lastchancetosee: It's more that i've been on the receiving end of the behaviour by some trade unions on construction sites that make it cost prohibitive and downright counterproductive some of the requirements they emplace on the site.

That said most unions actually act decently and are actually there for their members, it's just the 1% that ruins the name for the rest of them

@Drakesy: Thank you for explaining.

They can be tough, especially about safety, and are sticklers for the rules, but that's what collective bargaining is about. On the other side, they can offer extraordinary support to people who are being bullied or disadvantaged in the workplace.

I'm being a bit facetious here, but if you applied the 1% rule to every profession, you'd probably hate them all, including your own.

@Lastchancetosee: When it comes to the CFMEU and MUA they are the bullies, so @Drakesy I'd argue these unions make a larger portion than 1% across the country.

When it comes to "safety, sticklers for the rules". That's not what is counterproductive, it's shifting responsibility of their unsafe and reckless behavior and saying "well it shouldn't be possible for me to do this in the first place". Case in point, we had an operator fall asleep on night shift next to a stair case and he fell down, got some bruises or something. There was then a safety incident requiring engineering to design and install covers for the stairs (pretty stock standard stairs nothing special or weren't overly steep). No consequence to the operator for 1. falling asleep and 2. Not being fit for work. So yeah, extraordinary support to members, you can pretty much get away with murder.

If the AEU agrees on the new EBA, you will only be getting a pay rise of 1%×2 (1% rise in Jan and 1% rise in Jul), essentially agreeing to a pay cut when the inflation rate is at 5.1%… AEU has no teeth.

Salary doubled since covid? This is sarcastic right?

Yes. But imagine a monopoly game of 4 where everyone had $1500 at start of covid. Then every time 1 person went past go, they would get $1000 while other players got $200. On average, everyone's salaries doubled to $400.

Covid inflation bomb in a nutshell.

@orangetrain: Yeah right…. well mine most definitely did not double. My hourly rate went up about 14% since march 2019 (same job), however I get about 10 hours less overtime now, so I get the same at the end of the fortnight.

@Woody982: No, but someone just got much richer, diluting other people's cash. The media are saying it's due to war with Russia yet we're sitting on a massive cash infusion by RBA.

People have less money to spend, less demand for products, price goes down/doesn't rise as fast.

How are we better off if they take away the money in interest either way alot of people are going to pay more given the debt situation of this country.

It's not meant to make people better off in the short term, it's meant to control inflation, which helps in the long term.

@brendanm: Better way to control inflation, stop pumping so much cash. The RBA doubled the money supply over three years. Your cash is already now worth half as much as it was at start of covid due to massive dilution.

But the media is saying the Russian war is to blame. Your masters don't want you to understand why RBA is panicing and raising rates.

@orangetrain: I already know this, and have made multiple posts about the printing of money being to blame. Sadly we can't go back in time and have a competent government.

low interest rate leads to more $ floating around in the economy.

More $ in the economy on the same amount of goods = everything costs more $ for the same amount of goods

Except we also had a bad shortage of goods globally which exacerbates the problem even more

The higher the interest rates the more people are likely to pay off debt and also save money as they can earn interest on their money. It slows down the economy and may cause a recession, because there are so many people with mortgages and as interest rates rise they need to service higher and higher debt instead of spending money on other things in normal society some will need to cut back so less money flowing through the economy.

It's the rich protecting themselves from losses. The average Jo pays more for milk, bread and essentials, for fuel, for services for consumer goods etc.

Everyone passes on the "buck" and the little guy has to suck it up.

Yeah the theory is that people will have less to spend, so buy less stuff, so less demand, so prices stop going up.

how are those million dollar mortgages taken out to keep up with the joneses looking now?

I thought the national sport was more keeping up with how many IPs the Jones' have :P

Basic due diligence and maths is still required but I actually do feel more for those people who have been forced to borrow far more for their home cos speculators were jacking up the price at the auction or something.

Nobody is twisting FHB 💪 and forcing them to buy what they can't afford.

Hoping people get spooked and sell so I can buy a place for me to live in :P

@ForkSnorter: This is correct.

From an environmental POV if you have an overpopulated world the best way to preserve the natural environment is to keep as many people as possible as far from it as possible. Cramming 6 million people into the Sydney basin wrecks that basin, but does far less damage than wrecking vast tracts of countryside through decentralising them.