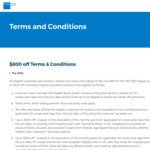

Join Bupa on eligible products and get up to $800 off. Offer applies to domestic policies only.

Quote ‘UPTO800OFF’ to redeem.

Based on the equivalent of the monthly premium applicable 30 consecutive days from the join date, a Family Gold Hospital Cover, with Top Extras Boost, in VIC. Hospital price includes an excess of $500, excludes any Australian Government Rebate, Age Based Discount and excludes Lifetime Health Cover Loading for domestic policies.

Terms & Conditions

The Offer

All Eligible Customers (see section 2 below) will receive from Bupa HI Pty Ltd (ABN 81 000 057 590) (Bupa) up to $800 off combined hospital and extras policies, to be applied as follows:

Customer must maintain the Eligible Bupa Health Insurance Policy (see section 2 below) for 30 consecutive days from the join date and be financial to be eligible to receive the dollar off promotion;

Yearly limits, other waiting periods, fund and policy rules apply.

The offer and dollar off that the eligible customer will receive is the equivalent of the monthly premium applicable 30 consecutive days from the join date, of the policy the customer has taken out

“Up to $800 off” is based on the equivalent of the monthly premium applicable 30 consecutive days from the join date, on a Family Gold Hospital Cover, with Top Extras Boost, in VIC. Hospital price includes an excess of $500, excludes any Australian Government Rebate, Age Based Discount and excludes Lifetime Health Cover Loading for domestic policies.

Up to $800 off” is based on the equivalent of the monthly premium applicable 30 consecutive days from the join date, for couple and family Gold complete hospital cover in VIC, with Top Extras 90. Hospital price include an excess of $500. Price excludes any lifetime health cover loading, age based discount or government rebate for corporate policies.

Yearly limits, other waiting periods, fund and policy rules apply.

Eligibility

The Offer is available to you if you:

are a new Bupa health insurance domestic customer and have not in the last 60 days prior to join date held a health cover or been insured with Bupa;

are an Australian resident over the age of 18;

take out an Eligible Bupa Health Insurance Policy (see section 3 below) 01/08/2022 and 14/09/2022 and such policy must commence by 14/10/2022;. Customers must maintain that cover and meet all payment obligations for 30 days to receive the dollar off promotion.

pay your health insurance premiums by direct debit or payroll deductions (if available);

Short Stay Visitors Covers, Overseas Visitors Covers, Overseas Student Health Covers who are transferring to a Domestic policy are eligible

provide a valid email address; and

if joining online, use promo code UPTO800OFF.

The Offer is not available to employees [or contractors] of Bupa or any other Bupa Group company.

If you meet all the eligibility criteria above, you are an Eligible Customer

Eligible Bupa Health Insurance Policy

An Eligible Bupa Health Insurance Policy is a single, single parent, single parent plus, couple or family or family plus combined Hospital and Extras product or packaged product issued by Bupa and excludes:

Hospital only products;

Extras only products;

Ambulance only products;

Short Stay Visitors Covers, Overseas Visitors Covers, Overseas Student Health Covers

Any company funded Bupa health plans (either corporate split bill or corporate subsidised)

General

The Offer is not available with any other Bupa promotional join offer provided by Bupa.

If you breach these terms and conditions before becoming entitled to the Offer then Bupa may elect, acting reasonably, not to award you with the Offer. If Bupa discovers the breach after the Offer has been awarded, then Bupa may decide, acting reasonably, to remove the Offer from your account.

Bupa reserves the right to extend this Offer.

Bupa is not liable for any loss or damage suffered because of this promotion (except that which cannot be excluded by law).

The offer is available only if you join through Bupa direct channels and is not available if you join through a price comparison website.

Health insurance is a scam