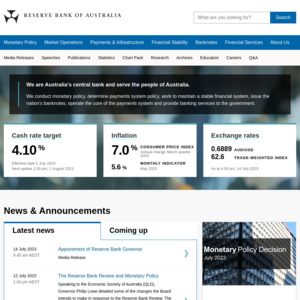

With the recent increase in the official cash rate to 3.85% I'm looking to hear your thoughts as to weather you agree with Philip lowe and the reserve bank for being aggressive with interest rates to stifle inflation, or perhaps you feel they are out of touch with the average Aussie?

I'm interested in public perception.

Be careful of what people wish for. RBA is now more embolden and united after the abuse they get and Mark Bouris' rant today (he should have known better) will make next month's 0.25% increase a surety.