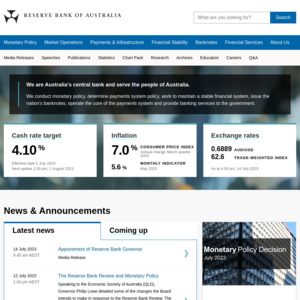

With the recent increase in the official cash rate to 3.85% I'm looking to hear your thoughts as to weather you agree with Philip lowe and the reserve bank for being aggressive with interest rates to stifle inflation, or perhaps you feel they are out of touch with the average Aussie?

I'm interested in public perception.

I think the big issue the RBA has, is that know they cant tame this current bout of inflation by simply jacking up interest rates. But they have no other means to deal with it. What else exactly do they have in their arsenal to control inflation?

My problem is that i just dont understand their reasoning behind the current increase. They flagged batter than expected employment and rising housing prices. I mean how do they measure healthy employment figures as being an overall factor causing inflation to sit high? And im more confused by how any rise in current housing prices can be considered inflation when prices have dropped by a good 10% in many areas. Is that a consideration when it comes to inflation? Or do they only ever consider prices going up and not down?