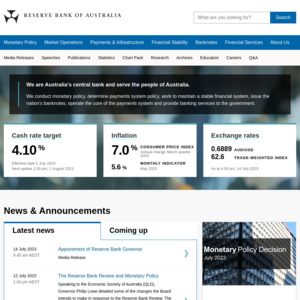

With the recent increase in the official cash rate to 3.85% I'm looking to hear your thoughts as to weather you agree with Philip lowe and the reserve bank for being aggressive with interest rates to stifle inflation, or perhaps you feel they are out of touch with the average Aussie?

I'm interested in public perception.

Been there - done that

The Australian economy last experienced a period of stagflation in 1975, when unemployment reached 5.3% and inflation reached an astonishing 14.4%

Took many years to fix it