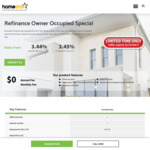

Cheapest home loan rate in Australia!

Limited Time Only

Homestar Finance has introduced the cheapest home loan rate in Australia, the Refinance Owner Occupied Special.

With an interest rate of only 3.44% and a comparison rate of 3.45%, making it the cheapest home loan rate in the market.

The home loan is only for borrowers who are refinancing with a maximum LVR of 80% and a maximum borrowing amount of $600,000.

“This is ground breaking for Homestar Finance” says Mike Tatlow, Digital Marketing and Sales Manager for Homestar Finance. “

Credit services and loan management provided by Homestar Finance Pty Ltd Australian Credit License 390 860.

Fine print:

Reviews seem ok - https://www.productreview.com.au/p/homestar-finance.html

Anyone with them?