Was looking for cheap Private Health Insurance to avoid paying the Medicare Levy Surcharge after getting a pay rise.

You can avoid paying the extra 1% (between $900 - $1050 depending on how much you earn) in tax if you take out this private health insurance.

I am paying $1053 for basic hospital and basic extras and will get $150 back as an eGift card = $903

I'm still $900 out of pocket but at least I am getting something for it.

Terms and Conditions below:

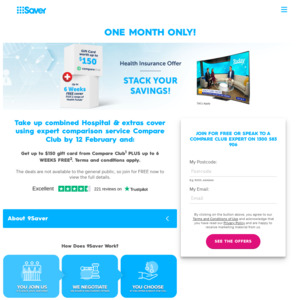

Take out a selected combined Hospital and Extras cover with Bupa and 9Saver will send eligible couples/families/single-parent families:

$300 9Saver Prezzee eGift Card

or a

$150 9Saver Prezzee eGift Card for eligible singles.¹

Bupa had the lowest average premium increase at 2.99% of the four largest insurers in April 2019. The industry average was 3.25%.²

Less to pay: when you visit a Members First provider across dental, physio, chiro and podiatry, you could get 60-100% back on your regular check-ups and consultations.³

To be eligible for this offer from Bupa HI Pty Ltd (Bupa) and Revtech Media Pty Ltd (Revtech Media) you must be a new Bupa customer who resides in Australia, who takes out an Eligible Bupa Health Insurance Policy between 22 July 2019 and 13 September 2019 on direct debit, or payroll deduction (if available), and provides the promotional code ‘9Saver’ upon sign-up. An Eligible Bupa Health Insurance Policy is a single, single parent, single parent plus, couple, family or family plus selected combined Hospital and Extras product or packaged product issued by Bupa. If you are an eligible customer and take up the 9Saver Health Insurance Offer with Bupa between 22 July 2019 and 13 September 2019 RevTech Media will send you a Prezzee eGift Card to the value of $300 for eligible couples/families/single parent families or $150 for eligible singles. Terms and conditions available here. To be eligible to receive the Prezzee eGift Card you must take up selected combined Hospital and Extras cover with Bupa and remain a member for 60 days. Offer not available with any other Bupa promotional or ongoing offer. The Prezzee eGift Card is subject to separate Terms and Conditions available here.

2The four largest Insurers as at March 2019 are Bupa, Medibank, NIB and HCF. See here for more information on Average Premium Increases by Insurer by Year.

3For most items at our Members First extras providers covering dental, physio, chiro, podiatry consultations and selected optical. Yearly limits, waiting periods, fund and policy rules apply. Excludes orthodontics, orthotics and hospital treatments. Set benefits apply at other providers.

9Saver is an initiative of RevTech Media Pty Ltd and Nine Entertainment Corporation, and is operated by RevTech Media Pty Ltd. RevTech Media receives an upfront commission for each member who takes up the 9Saver Health Insurance Offer with Bupa. RevTech Media returns up to $300 of this commission to eligible participants in the form of a Prezzee eGift Card. These commissions are shared with Nine Entertainment Corporation.

Bupa is a crappy fund. I don't recommend them at all.