Saw the offer on TV tonight, logged into Youi, answered one question saying I am using my car less (actually travelling half the usual!) and received a confirmation email 20 minutes later. Easy as!

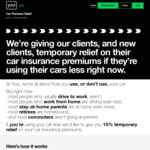

It’s for new and existing customers. All details and T&C’s as per link.

My thoughts….While a lot cars are actually being used less, make sure your answering truthfully, as with anything insurance related, they may knock back a claim if you have lied!

Still 15% to expensive