Hey all,

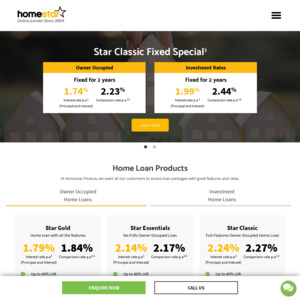

Noticed here that Homestar just dropped their 2 year fixed product (already crazy competitive) from 1.88% -> 1.74%.

Best part (beyond being the lowest 2 year fixed product around) is that it reverts back to about 2.14-2.24% with 80% LVR and there is an option at 60% LVR to get 1.79% (1.84% CR) which is also the lowest rate at 60% LVR that I know of.

Hope it helps!

Do you know if these fixed rate products apply to existing home loans transferred from another bank?