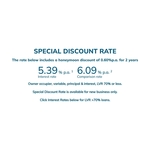

I haven't used this bank, just saw a not bad interest rate with $150 annual fee on Offset Account.

There is another $150 annual fee, even they advertise "no monthly fee".

The special rate discount seems not covering investment property loan type.

Some other aspects:

- No establishment fee

- No Horizon solicitor fee

- No Valuers fee

- The special offer covers the standard valuer fee for $300K+ loan

$150 annual fee =

0.015% add to 1M loan balance, rate goes up to 5.405%

0.03% add to 500K loan balance, rate goes up to 5.42%