paying 4.89% variable rate with tictoc but their website has 4.56% variable rate for new customer. Advertised rate looks good in current time . Its no frill loans .

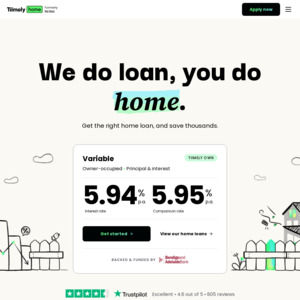

Variable P&I LIVE-IN

4.56% p.a. Interest rate

4.57% p.a. Comparison rate

- Up to 30 years loan term

- 10% deposit minimum

- No fees upfront or ongoing

- Unlimited additional repayments

- Free online redraw on any additional repayments

- Offset account optional for $10/month

Doesn't include yesterdays 0.25% increase