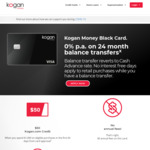

Available until 28 February 2021 and only via Finder, the Kogan Money Black Card offers 0% p.a. interest for 24 months on balance transfers with no balance transfer fee. It also offers an ongoing $0 annual fee and $50 Kogan.com Credit when you spend $1,000 in the first 60 days.

Features of this card

- 2 year balance transfer offer. Save on interest charges with 0% p.a. on balance transfers for up to 24 months with no balance transfer fee when you apply through Finder by 28 February 2021. Any unpaid balance at the end of the introductory period will revert to the cash advance interest rate of 21.74% p.a. Please note that you do not get interest-free days on purchases while you have a balance transfer.

- Bonus $50 Kogan.com Credit. Spend $1,000 on eligible purchases in the first 60 days and you’ll get $50 to spend at Kogan.com within the next 12 months (credit will be in your account within 10 weeks of meeting the spend requirement).

- $0 annual fee. The Kogan Money Black Card does not charge an annual fee. Ever. It also offers up to 4 additional cardholders.

- Rewards. Earn 2 points / $1 at Kogan.com, 1 point / $1 everywhere else. Redeem rewards for purchases on Kogan.com or for credit card payments. 100 points = $1 of credit.

- Interest rates. Purchase interest rate of 20.99% p.a., cash advance rate of 21.74% p.a. Interest-free period of up to 55 days (if you do not have a balance transfer).

- Complimentary Kogan First Membership. Get free shipping on thousands of products, express shipping upgrades and exclusive specials (currently valued at $99 / year).

Eligibility. To apply, you need to:

- Apply via Finder

- Be 18 years of age or over, and

- Earn more than $35,000 per year, and

- Be a permanent Australian resident, and

- Have a good credit rating and be in permanent full-time or part-time employment, or be self-employed.

- Request the balance transfer within 90 days of account opening (you can transfer up to 80% of your available credit limit).

Read the full card review and apply through Finder https://www.finder.com.au/kogan-money-black-card-exclusive-offer

Very low offer compare to $300-$500 credit offer just recently.