Hello, ozbargain friends.

I come to you with a generous and voluptuous deal, delivered to you from the bottom of my heart for the greatness of the community here and its members.

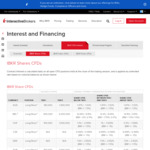

Very recently, IBKR has increased their margin limit for retail investors in Australia from $25k to $50k AUD. This now offers an unbeatable rate on margin in Australia. About IBKR Australia Margin Accounts.

Old post from last year where the limit was $25k: https://www.ozbargain.com.au/node/615679

Be very careful. This looks like a very risky proposition.