Recent Tarrifs rises may be impacting your Temu purchases, but this spreadsheet can help you budget for that next Aldi Special Buy.

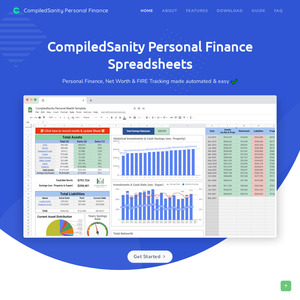

This formula driven and automated net worth and savings tool has been really popular on OzBargain and reddit, and hopefully you'll enjoy it too. The sheet is made to help track monthly finances and provides a bird's eye view of your financial position each month. For example, I was able to see that if I had invested in NVIDIA in 2019 I wouldn't really need to track my investments anymore.

Changes since the last deal – new graph compression features, XIRR performance changes, improved historical price lookups and many other community suggested improvements.