Lowe's rate rises haven't done much to stop the inflation on the retirement age, but don't give up on your plans to retire before 90!

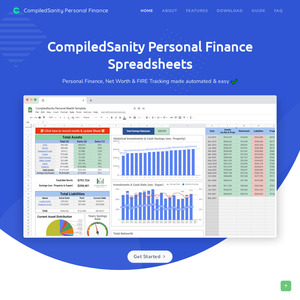

This formula driven and automated net worth and savings tool has been really popular on OzBargain and reddit, and hopefully you'll enjoy it too! The sheet is made to help track monthly finances and provides a bird's eye view of your financial position each month. For me, I saw the light on how much I was spending on OXO Good Grips and Victorinox knives every month (not nearly enough).

——

FAQ #1: Why should I pay money for this?

The sheet is heavily automated, has live pricing and is a one-off payment rather than a subscription. If you're really interested, feel free to join the subreddit where I take future feature suggestions (and have for the past three years) and other users can help you debug and get set up.

FAQ #2: What permissions do I need to give and what information will you get off me?

All info is full self-contained, and never leaves the sheet. If you're particularly security conscious, there are 2 versions:

- FULL: Contains the full suite of automated features, but requires a few expansive permissions for them to work.

- SLIM: Doesn't support email updates, calendar reminders or the migration feature, but doesn't require those permissions.

Further FAQs can be found here

——

Hope you like it and here's to saving to buy-out Twitter in 2024.

What does your spreadsheet actually do / what does it do better than free alternatives?

Just answering to help with a question from last time.

Private financial solution compared to other cloud platforms

Live ETF, stock, crypto & managed fund prices & tracking

Property value & performance tracking dashboard

Loan, debt, mortgage & credit-card tracking and metrics

Monthly net worth & savings email updates

Included budgeting system

Automatic FIFO capital gains calculations for sold assets