Registered my NAB Classic credit card to go travelling and received an email with a cashback offer.

Ymmv and cashback amounts/spend amounts may vary.

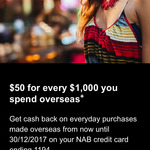

My particular offer was $50 Cashback for $1000 spend.

This offsets the 3% international transaction fee plus you get triple NAB points for overseas spend which brings the Classic card to approx 1 virgin velocity point per dollar spent. The platinum card will be closer to 1.5 velocity points per dollar.

T&C's

The cash back offer up to $300 is available to the customer addressed in this offer email, who has registered their NAB Rewards Classic Card ending xxxx.

For this offer, only everyday purchases made overseas in a foreign currency by the primary and any secondary cardholders for two months after departure from Australia will be considered. All overseas returns/refunds will be adjusted against your account.

Cash back will be applied to your eligible credit card account up to 6 weeks after the offer end date. This offer is subject to your account being open, kept in good standing and not overdue.

This offer is subject to your account:

being open = yep

kept in good standing = D'oh!

and not overdue = dammit.

I'm out.